Preface • Work summaryThe year 2024 is a year full of challenges and opportunities for the global optical communication industry. On the one hand, affected by the severe macroeconomic environment, the recovery of the optical communication market remains slow. The pace of global 5G deployment has slowed down. Overcapacity, inventory pressure, reduced construction demand from operators and delayed construction demand for data centers, etc., hinder the positive development of the global optical communication industry. But on the other hand, countries around the world are actively promoting the implementation of 5G applications. 5G construction is in the ascendant. The booming development of the digital economy such as artificial intelligence and data centers has an increasing demand for higher bandwidth and faster connection speeds, which will also effectively support the market demand for optical communications. The digital economy of major countries around the world continues to develop rapidly. Last year, the total digital economy of five countries including the United States, China, Germany, Japan and South Korea exceeded 33 trillion dollars, with a year-on-year growth more than 8%. The proportion of the digital economy in GDP is 60%. It is expected that from 2024 to 2025, the revenue growth rate of the global digital industry will pick up and steadily consolidate the foundation for the development of the digital economy. With the development of generative AI, it has driven the demand for optical module to fully enter a period of high growth. In particular, the demand for high-speed optical modules has increased significantly. It is expected that the global market size of optical modules may maintain a compound annual growth rate of 11% from 2024 to 2027 and is expected to exceed 20 billion dollars in 2027.

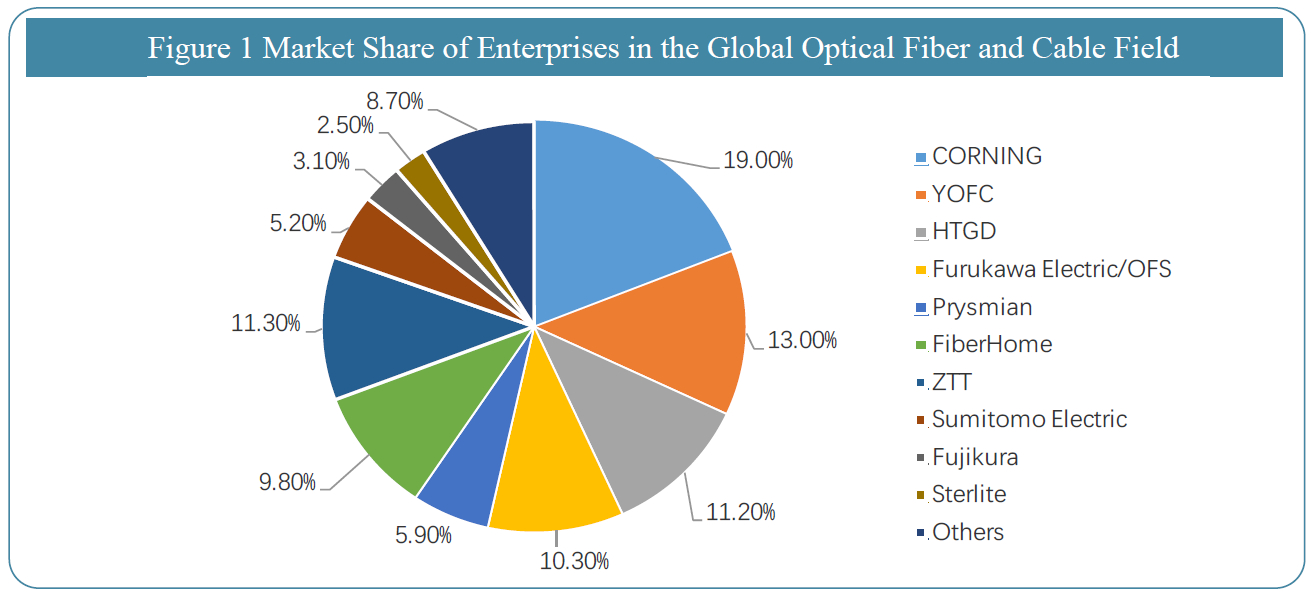

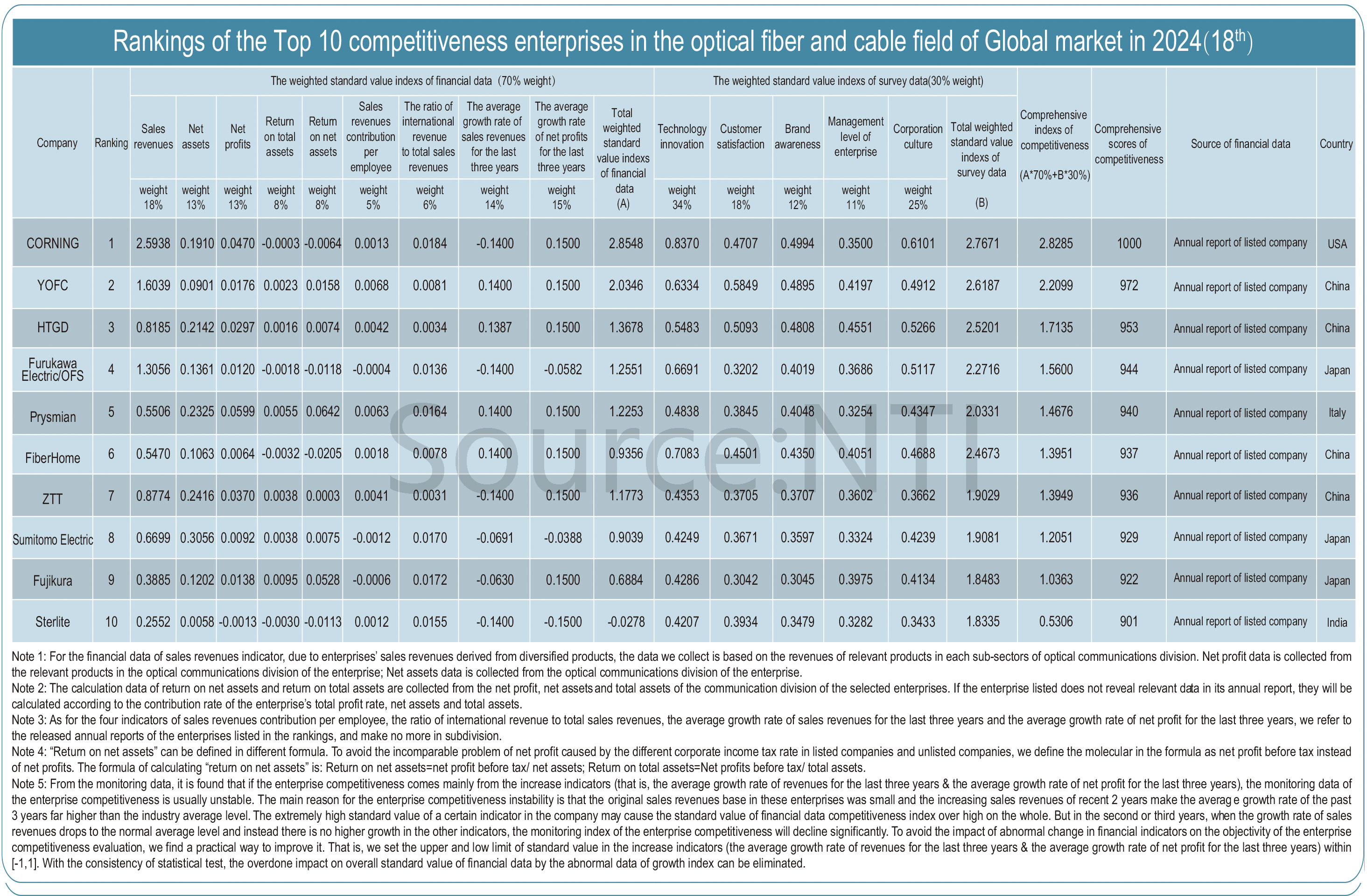

In the global optical fiber and cable list, the top ten global manufactures occupy 91.30% of the optical fiber and cable market share, showing strong competitive advantages. The top ten enterprises are occupied by five countries, namely from the United States (Corning), China (YOFC, HTGD, FiberHome, ZTT), Japan (Furukawa Electric/ OFS, Sumitomo Electric, Fujikura), Italy (Prysmian) and India (Sterlite). Among them, Chinese enterprises occupy four seats, accounting for 13.00%, 11.20%, 9.80% and 11.30% of the global market share respectively. Indian enterprise Sterlite is on the list for the first time, occupying about 2.50% of the global market share.

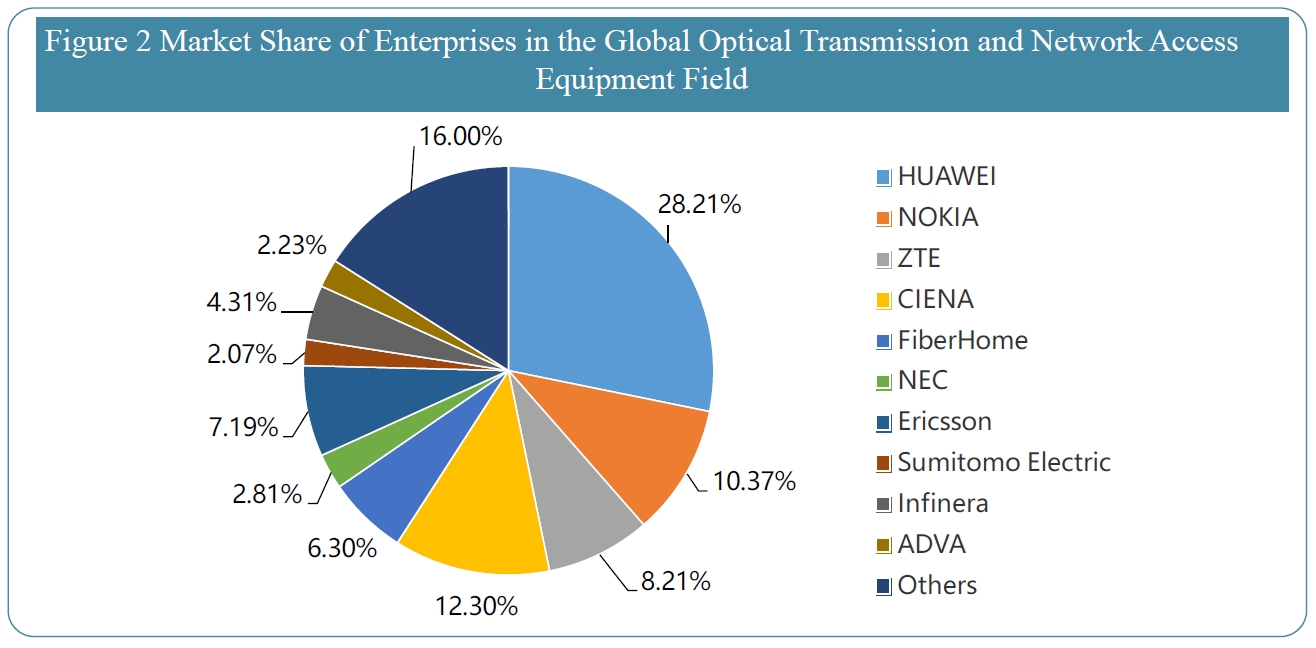

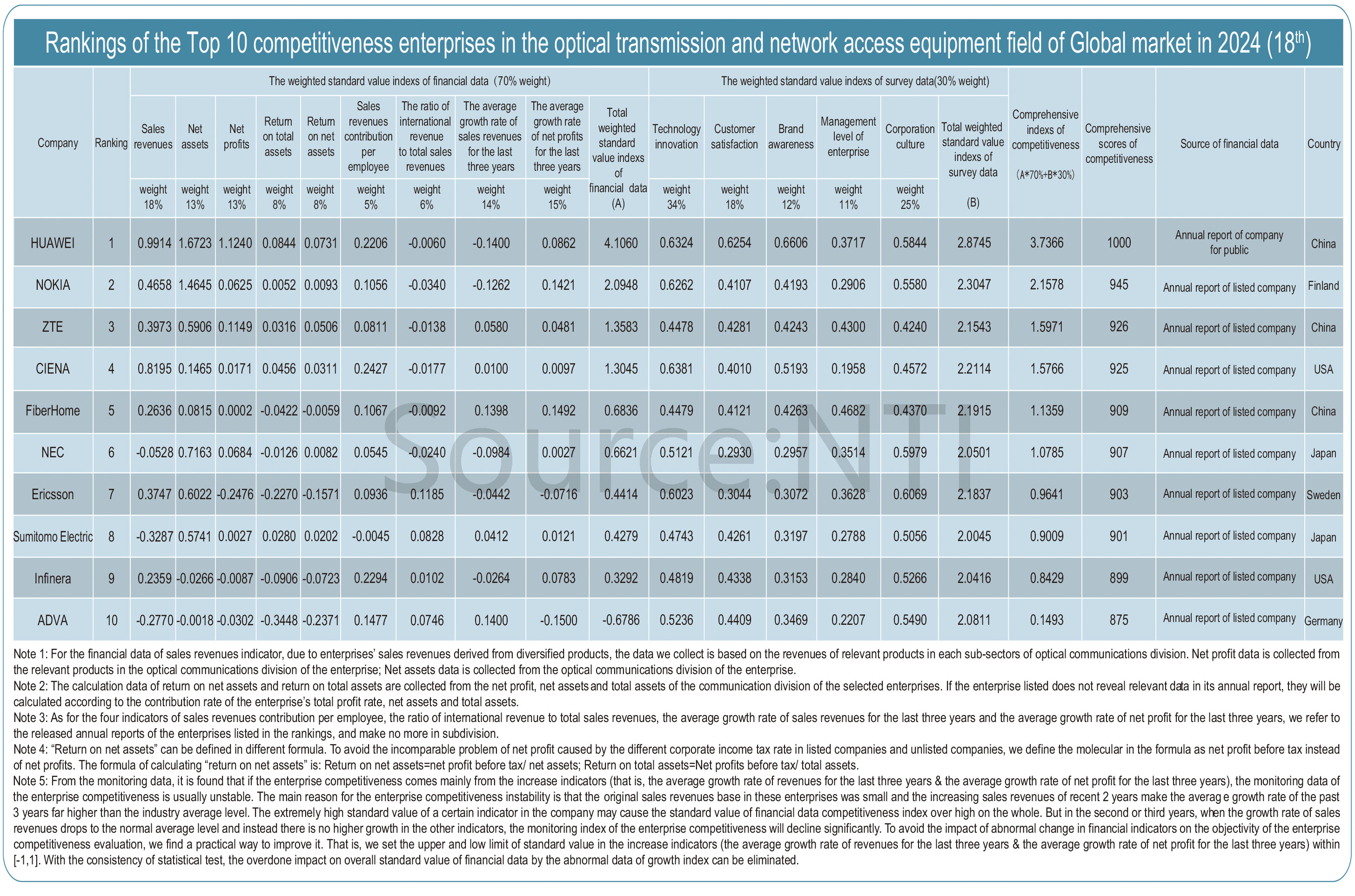

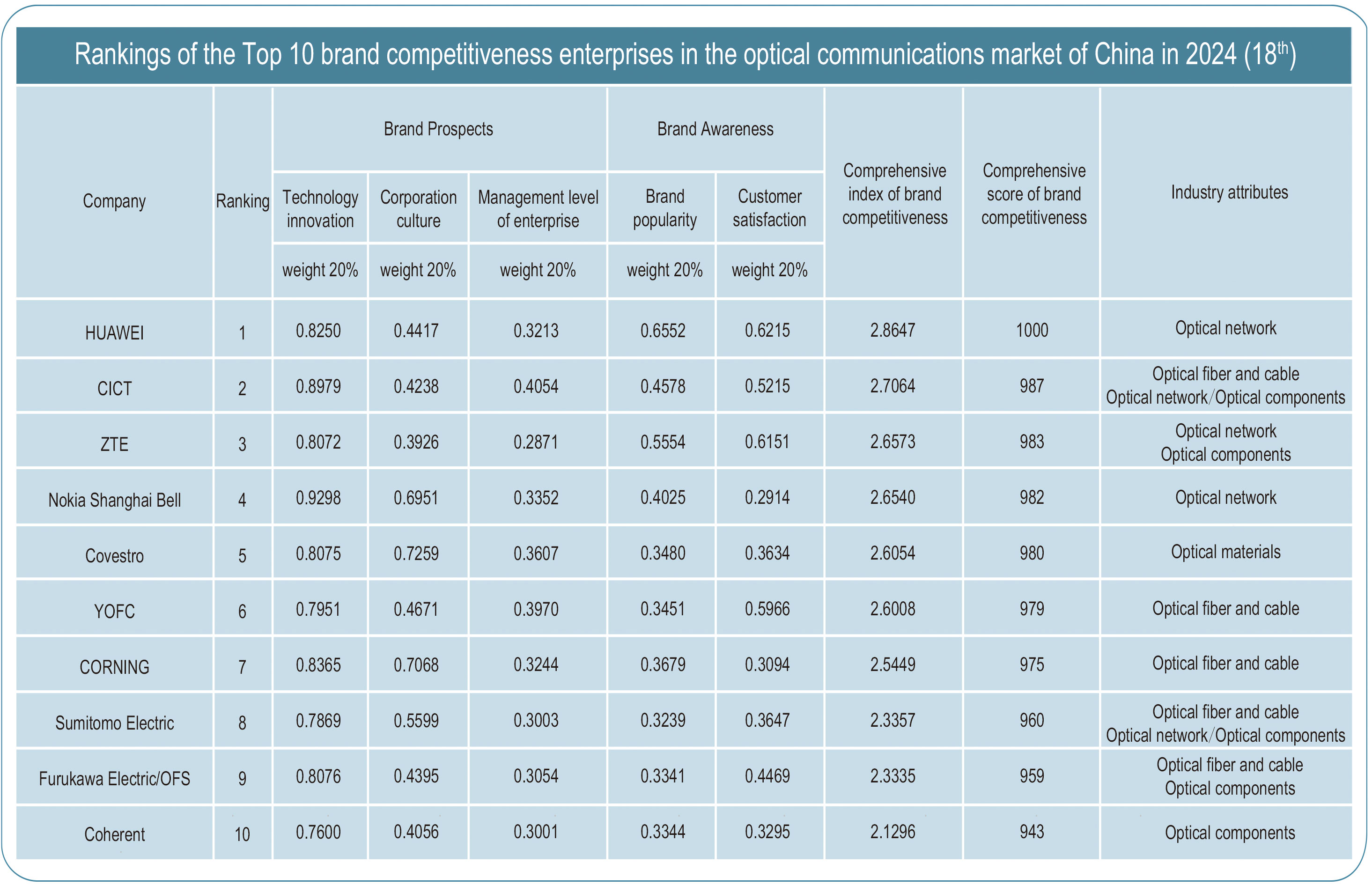

From the perspective of the financial data competitiveness index of enterprises, Corning, an American enterprise, take the lead by a wide margin with a strong competitiveness index of 2.8548. YOFC and HTGD rank second and third with competitiveness indexes of 2.0346 and 1.3678 respectively. The competitiveness indexes of other enterprises in the Top 10 are not much different. The difference between Furukawa Electric/ OFS and Prysmian is less than 0.1, which shows the fierceness of competition. In addition to YOFC and HTGD, Chinese enterprises FiberHome and ZTT rank among the top ten in the world with competitiveness indexes of 1.3678, 0.9356 and 1.1773 respectively. In the field of optical transmission and network access equipment, the optical transmission equipment(DWDM) market experienced a year-on-year decline of 13% in the first quarter of 2024. The optical transmission equipment markets in North America and some parts of Asia-Pacific declined most significantly.However, there are also some regions that achieved growth. For example, the Chinese market grew by 8%, and the Middle East and Africa(MEA) region even achieved a strong growth of 16%. In the list of the winner of the top 10 competitiveness enterprises in global optical transmission an network access equipment in 2024, the ten enterprises are from six different countries respectively, including the United States (CIENA, Infinera), China (HUAWEI,ZTE, FiberHome), Japan (NEC, Sumitomo Electric), Finland (NOKIA), Sweden (Ericsson), and Germany (ADVA). Chinese enterprise HUAWEI ranks first on the list. Its global share in otical transmission and network access equipment reaches 28.21%. NOKIA, ZTE, CIENA,FiberHome occupy the top five on the list with market shares of 10.37%, 8.21%, 12.30%, 6.30% respectively. The detailed global market share of optical transmission and network access equipment is shown in the following figure.

From the perspective of the financial data competitiveness index of enterprises, as a leading enterprise in the global optical transmission and network access equipment field, Chinese enterprise HUAWEI has opened up a gap with NOKIA (competitiveness index: 2.0948) with a competitiveness index of 4.1060, and its leading advantage is obvious. ZTE, CIENA,FiberHome follow closely behind, with competitiveness indexes of 1.3583, 1.3045 and 0.6836 respectively, showing strong financial competitiveness. In 2024, with the development boom of AI, computing power and data centers, the demand for optical module devices has fully

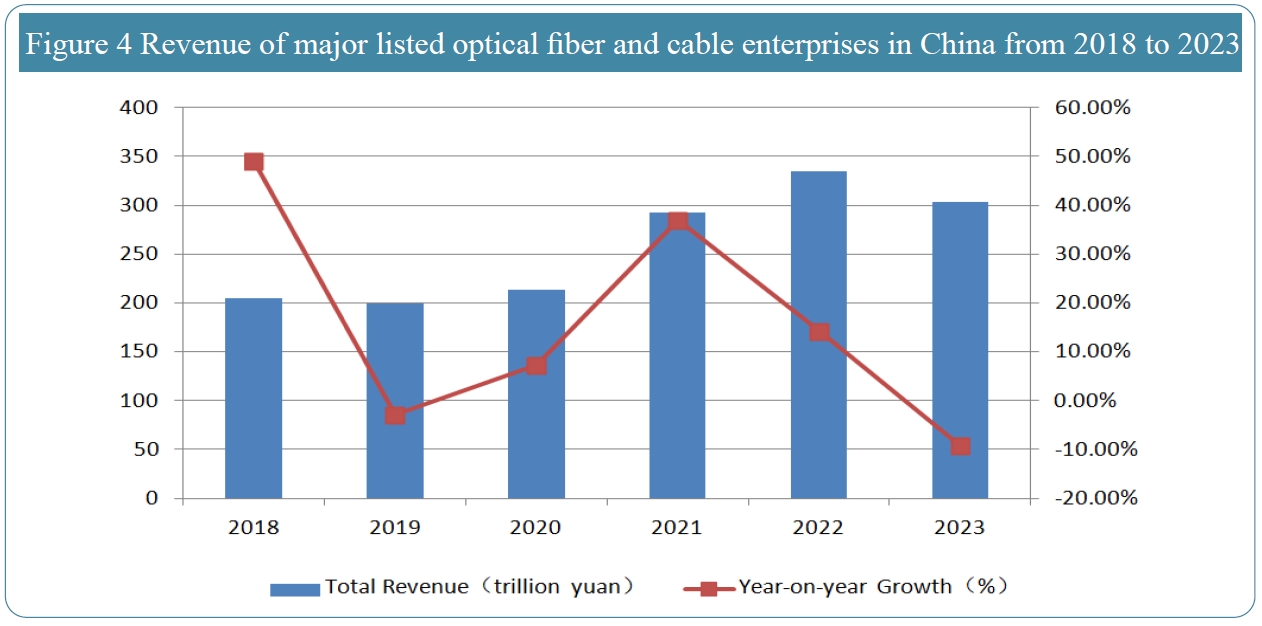

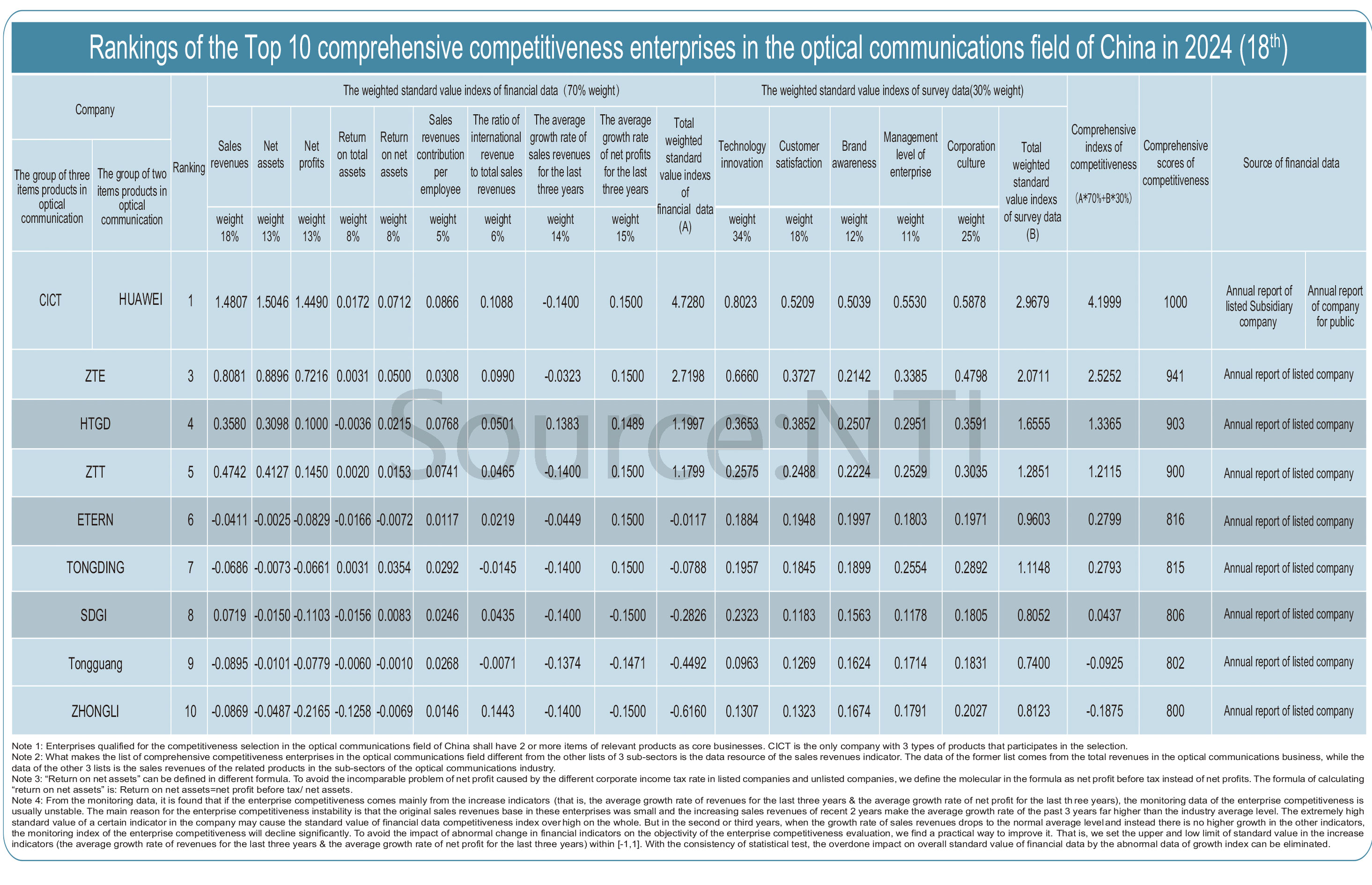

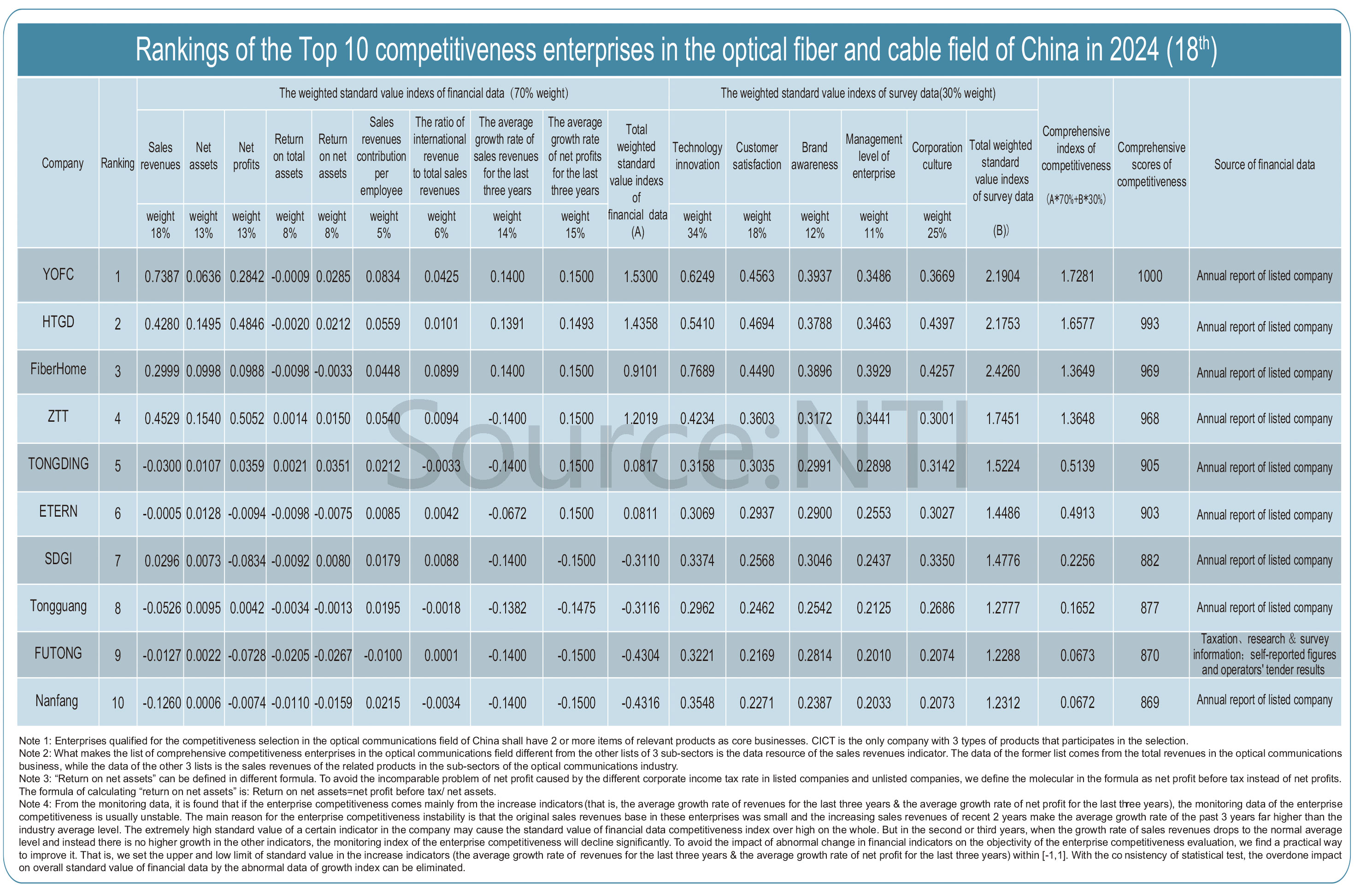

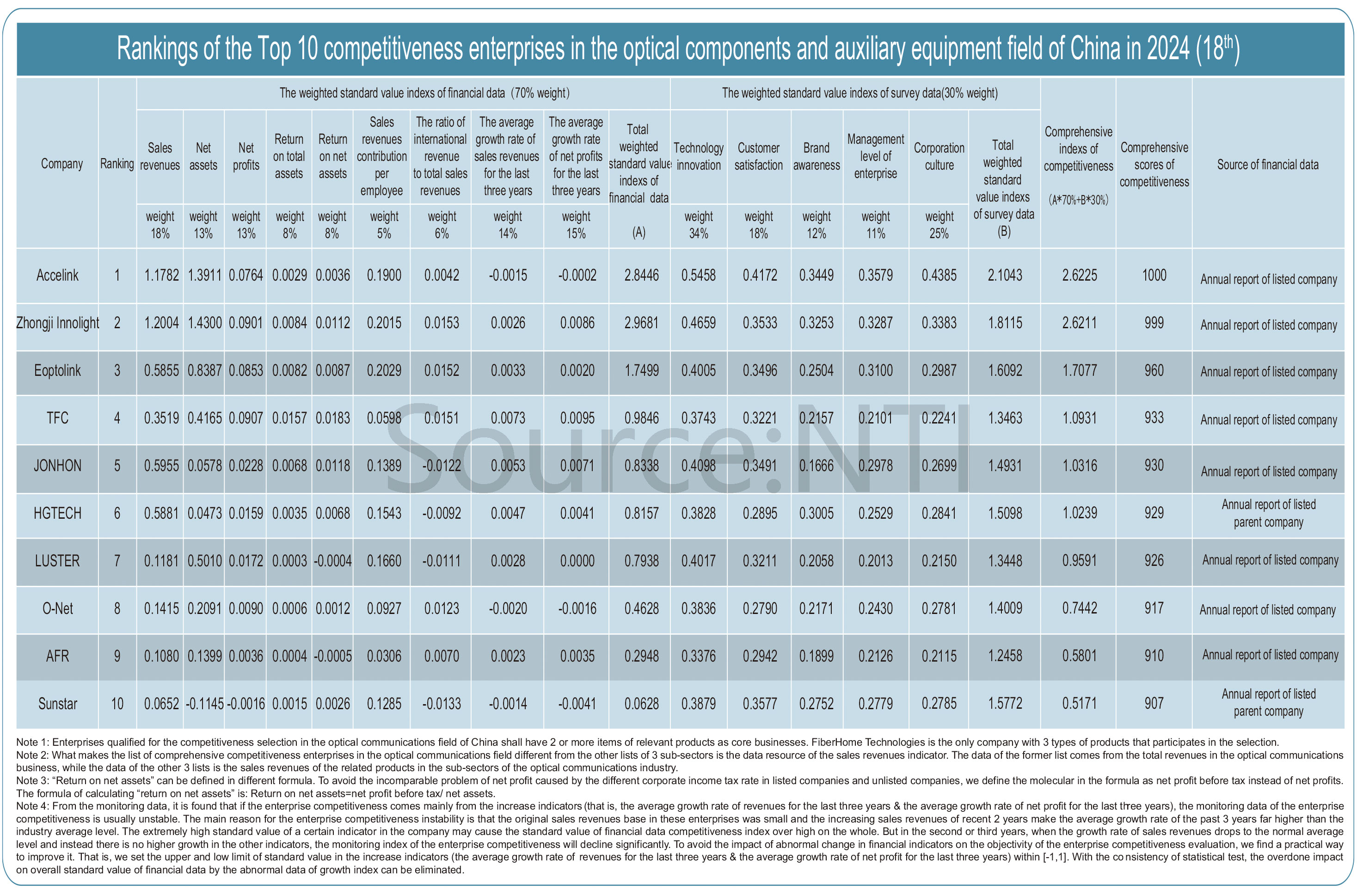

Through the analysis of the financial data competitiveness index, we can see Coherent, BROADCOM, and Zhongji Innolight rank among the top three global optical device enterprises with competitiveness indexes of 2.2477, 2.2070, and 1.4379 respectively. In addition to Zhongji Innolight, Chinese enterprises Accelink, Hisence Broadband and Eoptolink also rank among the top ten on the list with financial data competitiveness of 0.7008, 0.5572 and 0.3472 respectively. However, there is still a large gap in the competitiveness index compared with the top three enterprises, and there is still a large room for development in the future. The Chinese optical fiber and cable market is slowing down, but there is broad development space. In terms of China’s optical fiber and cable production, in the early stage, benefiting from the continuous growth of industry demand and capacity expansion, the domestic optical cable production generally showed an upward trend. Since 2020, driven by 5G investment and FTTR, the optical cable production has resumed growth. In 2021, 2022, and 2023, the optical cable production was 322 million, 346 million, and 323 million core kilometers respectively, maintaining a relatively stable demand situation as a whole. In 2024, as of the end of September, the cumulative optical cable production in China was 200 million core kilometers. Compared with the cumulative production in the same period of last year, the decline was 20.30%. The main reason for the production decline is still insufficient demand and insufficient orders for optical fiber and cable enterprises. In terms of the competitive landscape, major manufactures in China’s optical fiber and cable industry have undergone full competition in multiple communication cycle constructions and formed a relatively stable industry pattern. According to “The Winner of The Top 10 Competitiveness Enterprises in Optical Fiber and Cable Industry of China in 2024” list, YOFC, HTGD, FiberHome, ZTT, TONGDING, ETERN, SDGI, Tongguang, FUTONG, and Nangfang are ranked in the top ten. In terms of market share, the top 10 leading manufactures occupy about 91.74% of the market share. In terms of revenue, optical fiber and cable enterprises as a whole maintain a relatively stable state. According to annual report data, the total revenue of major listed optical fiber and cable enterprises in China was about 41.5 billion yuan, basically the same as the previous year.

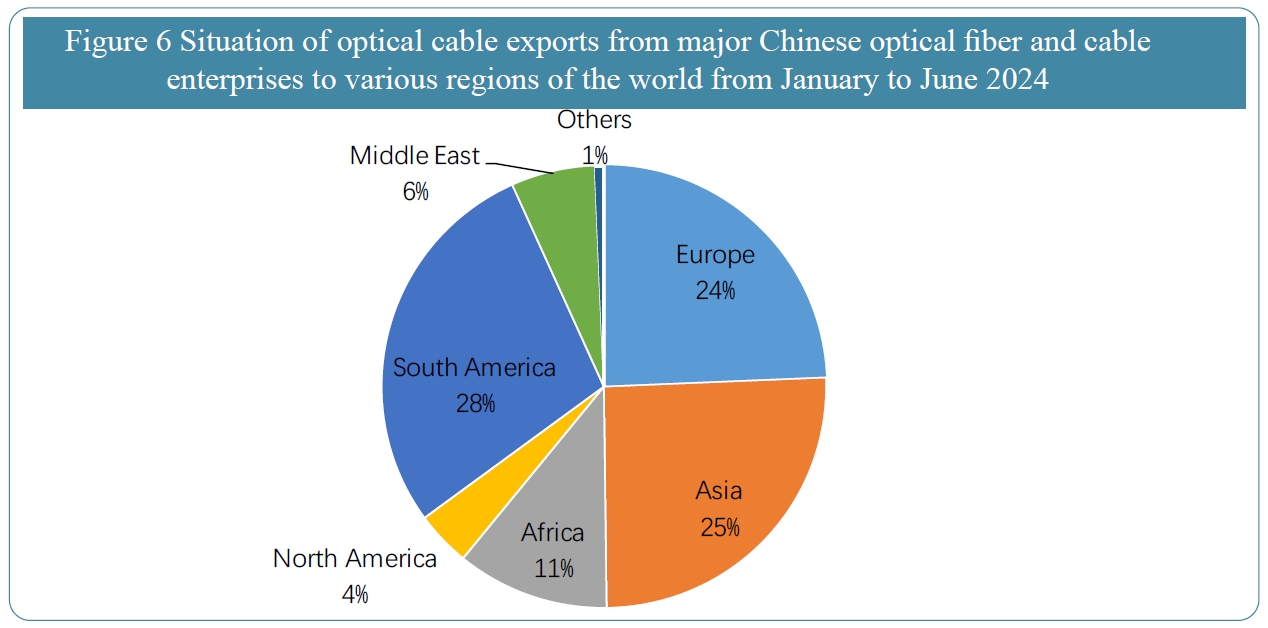

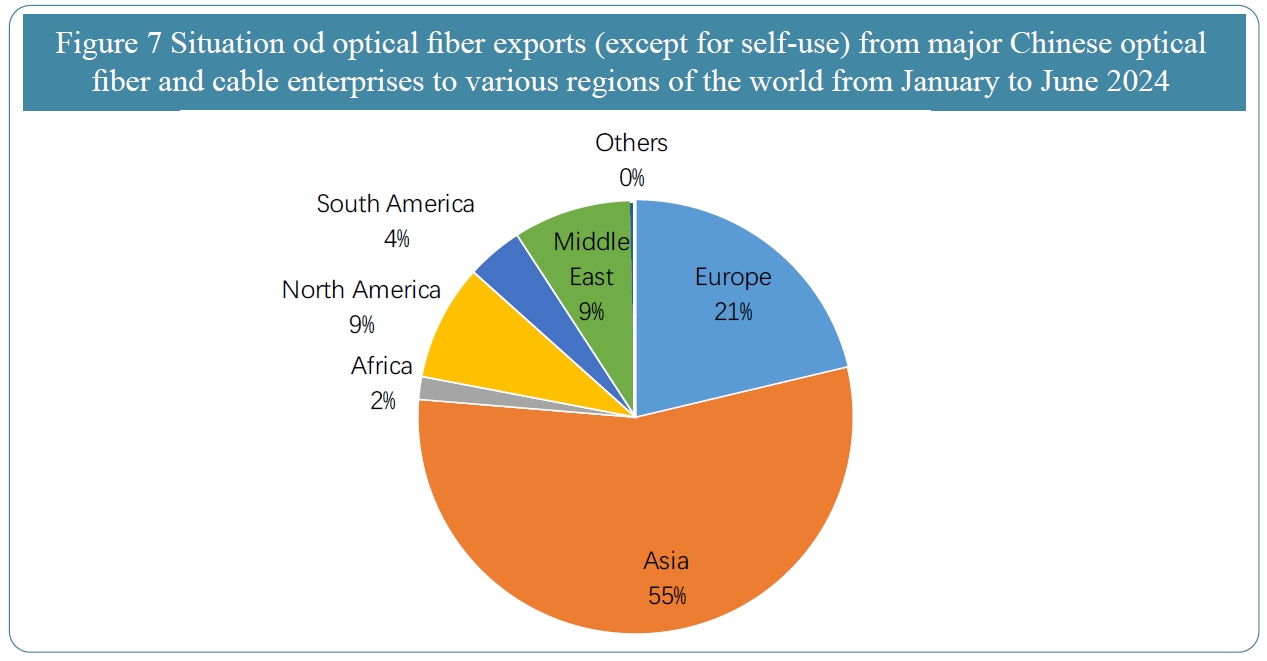

In terms of market, major optical fiber and cable enterprises are accelerating the expansion of overseas market,. With the development of China’s communication industry, the overall demand for optical fiber and cable will not decrease or disappear. However, it is a fact that the current growth is slowing down. As the domestic market demand stabilizes, Chinese optical fiber and cable enterprises are accelerating the exploration of overseas markets. In 2023, the annual export scale of optical fiber and cable enterprises is about 123 million cores. The main export regions are Asia, followed by South America and Europe. The export scale are about 40 million core, 28 million cores and 27 million cores respectively. The total export scale in North America is about 11 million cores, about 10 million cores in Africa, and about 6.5 million cores in Middle East, and about 750,000 cores in other regions.

In the first half of 2024, the export scale of optical fiber and cable of major Chinese optical fiber and cable of major enterprises is about 73 million cores, which is approximately equivalent to 59.35% of the annual export scale of major Chinese optical fiber and cable enterprises in 2023. If the export momentum is maintained, the export scale of optical fiber and cable in 2024 will slightly exceed that in 2023. However, choosing overseas export also require waiting for foreign countries to digest the current inventory. Moreover, due to macroeconomic fluctuations, the capital expenditure of overseas operators in 2024 has also slowed down. Coupled with disturbances from factors such as geopolitics, strengthened trade protection measures, and high interest rate levels, overseas business still faces challenges. New demands give birth to new tracks, and the demand for new types of optical cables is increasing. As the physical carrier for the operating of information systems in various industries, Internet data centers have become key infrastructure for the digital transmission and intelligent upgrading of the economy and society, and play a crucial role in the development of the digital economy. The scale and number of data centers are constantly expanding, and the demand for optical fiber is also getting higher and higher. Although the demand for ordinary optical cables is still strong and accounts for more than 90% of the market share, with the vigorous development of computing power network construction, the demand for new types of optical cables is showing a relatively fast upward trend. It is expected that by 2025, the demand for optical fiber and cable in China’s data center will reach 120 million core kilometers, which will bring new market space for China’s optical fiber and cable industry.

and supports backbone network transmission with large bandwidth, low latency, and long span. It is considered by the industry as the preferred optical fiber for 400G, 800G and future Tbit/s ultra-high-speed transmission technologies. In addition to the already commercialized G.654.E optical fibers, major optical communication enterprises are carrying out research and development on new-generation optical fibers and cables such as space-division multiplexing optical fibers and hollow-core optical fibers, and have achieved initial results. Subsequently, with the research and development and application of new types of optical fibers and cables such as space-division multiplexing optical fibers, hollow-core optical fibers, and even C+L optical fibers, multi-core optical fibers, and fewmode optical fibers, it will surely provide greater imagination space for the change of the future optical communication market pattern.

Finally, all the members of the review team of “Network Telecom” and “Annual Ranking Event of the Top 10 Enterprises in the Optical Communications of China & Global Market would like to express heartfelt gratitude for the participation and cooperation from the industry colleagues over the past 18 years. |

Rankings of The Top 10 Competitiveness Enterprises in the Optical Communications Industry of Global & China market in 2024 (18th) |

|||||||||

|