|

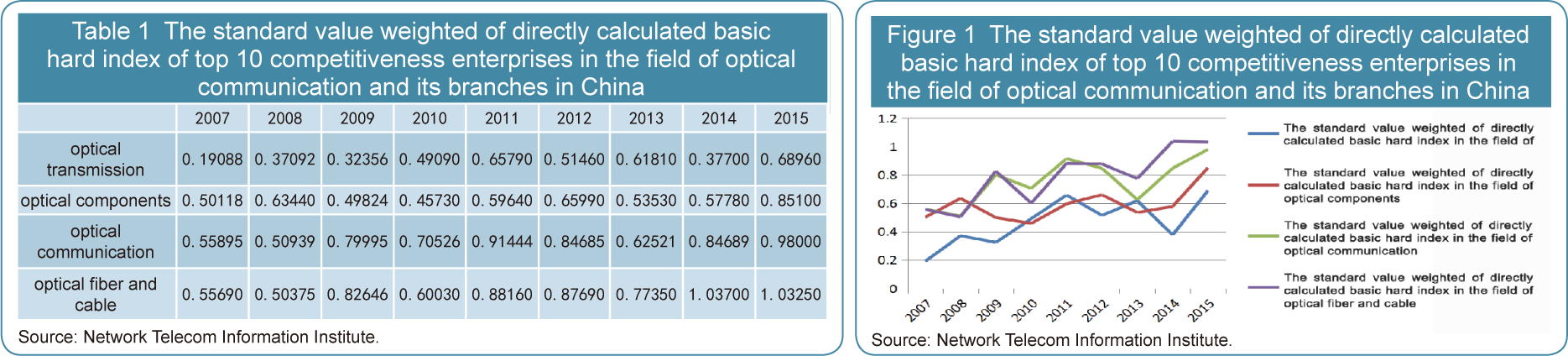

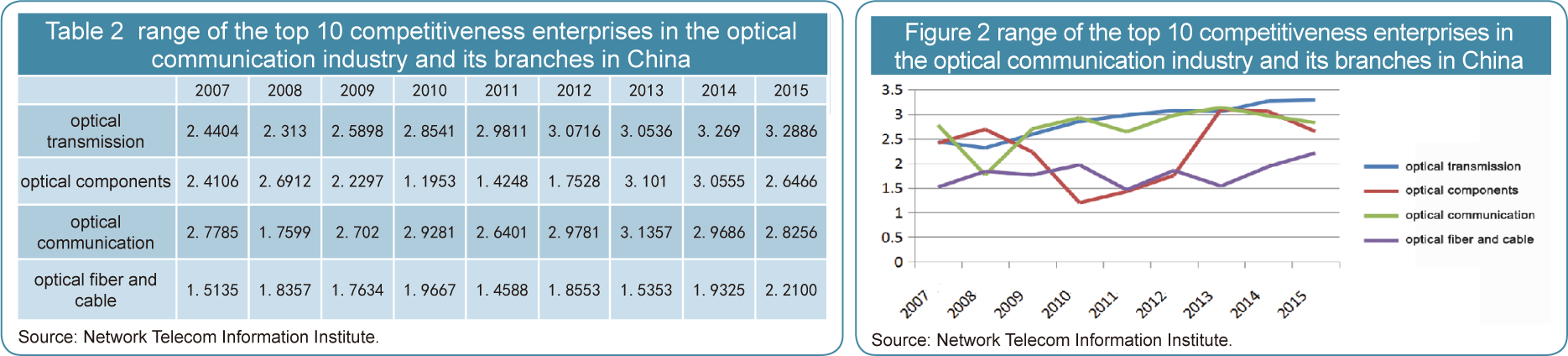

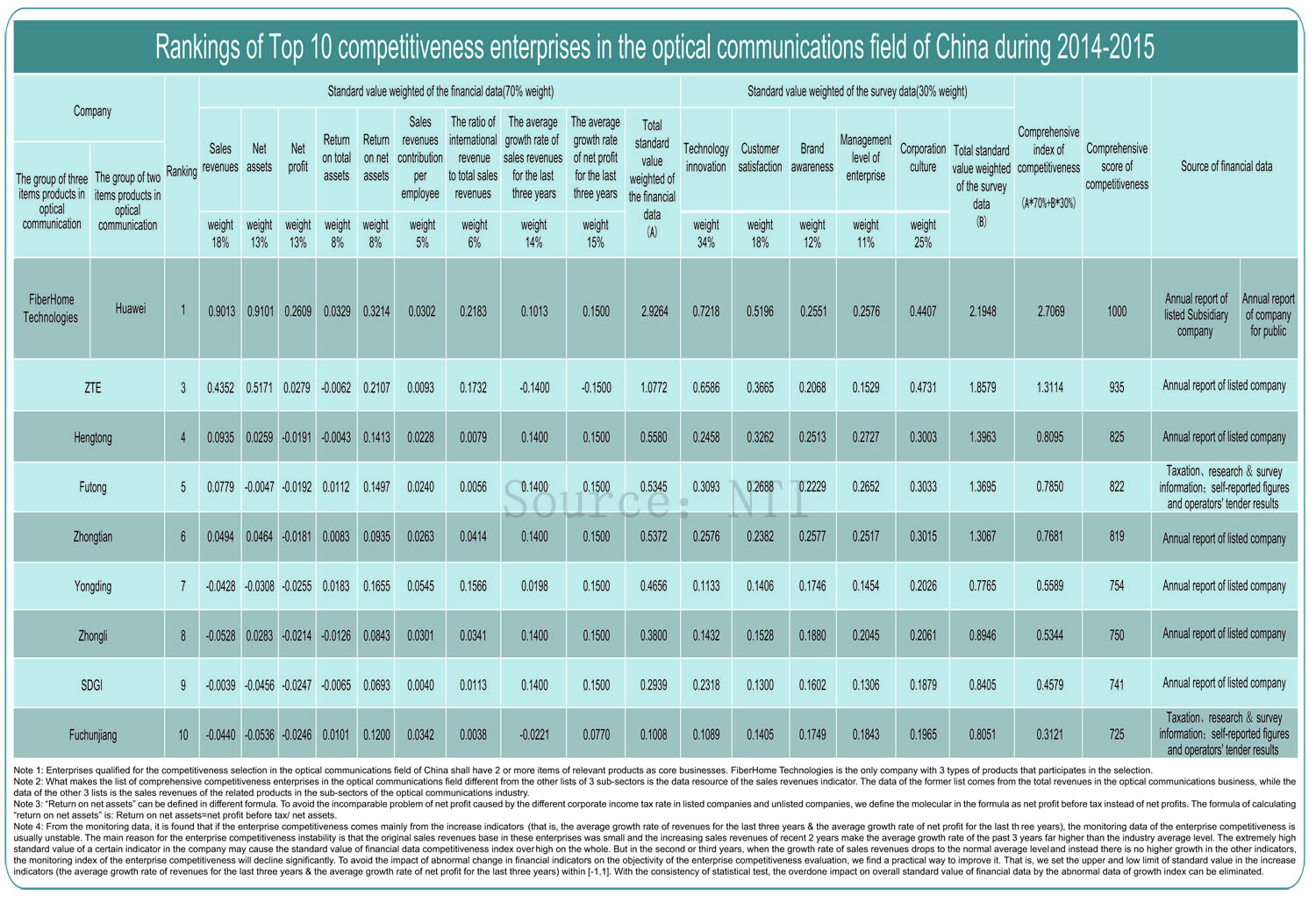

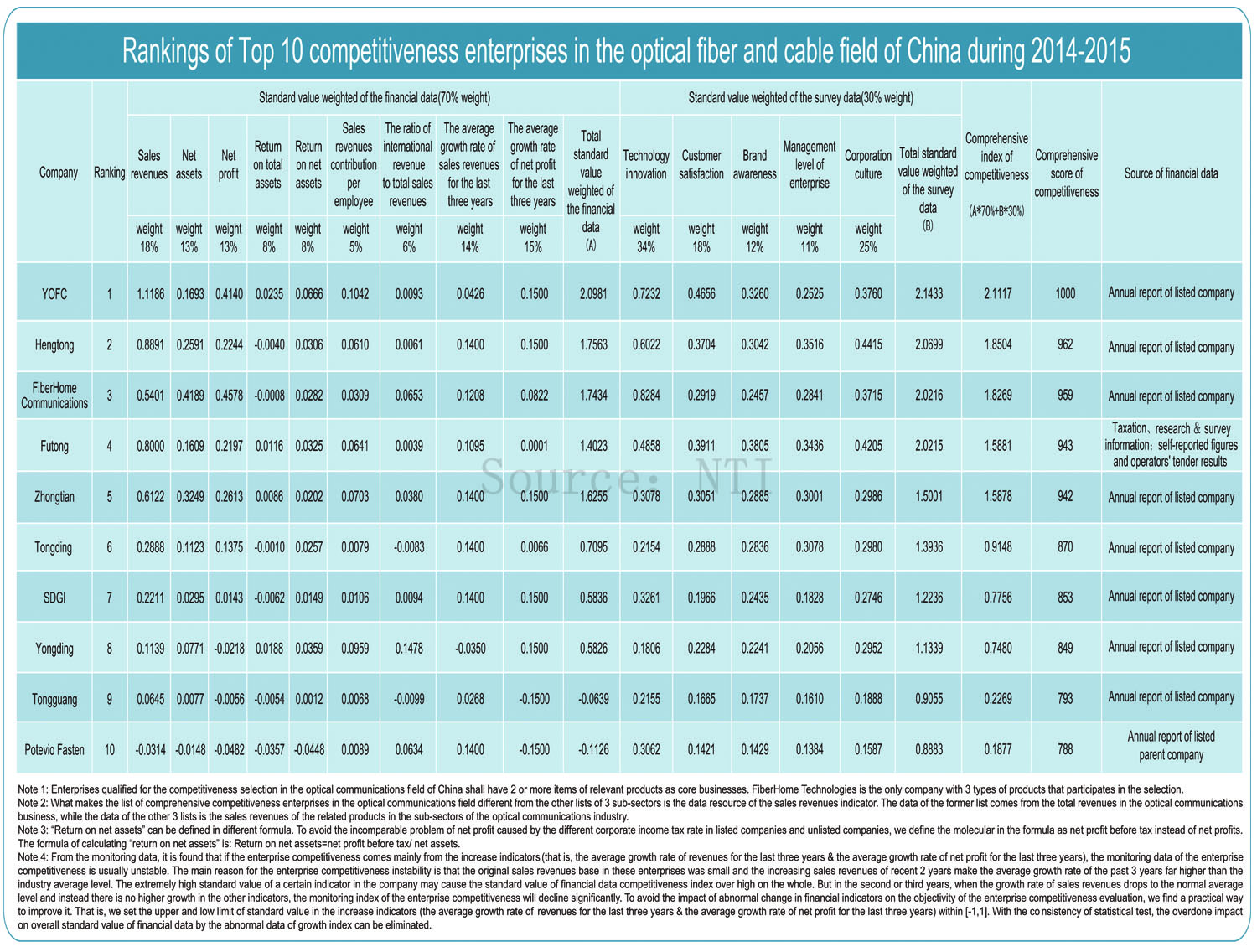

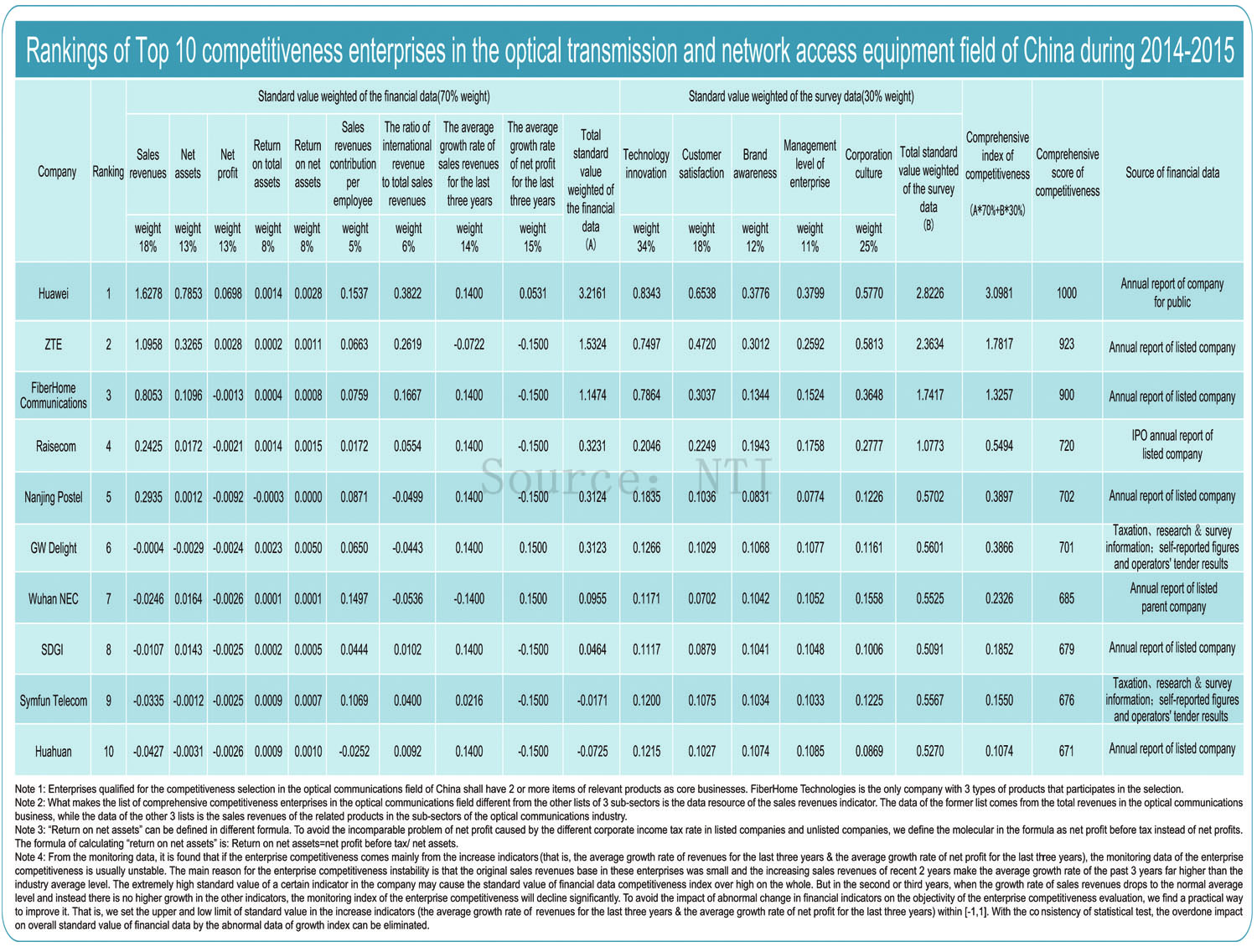

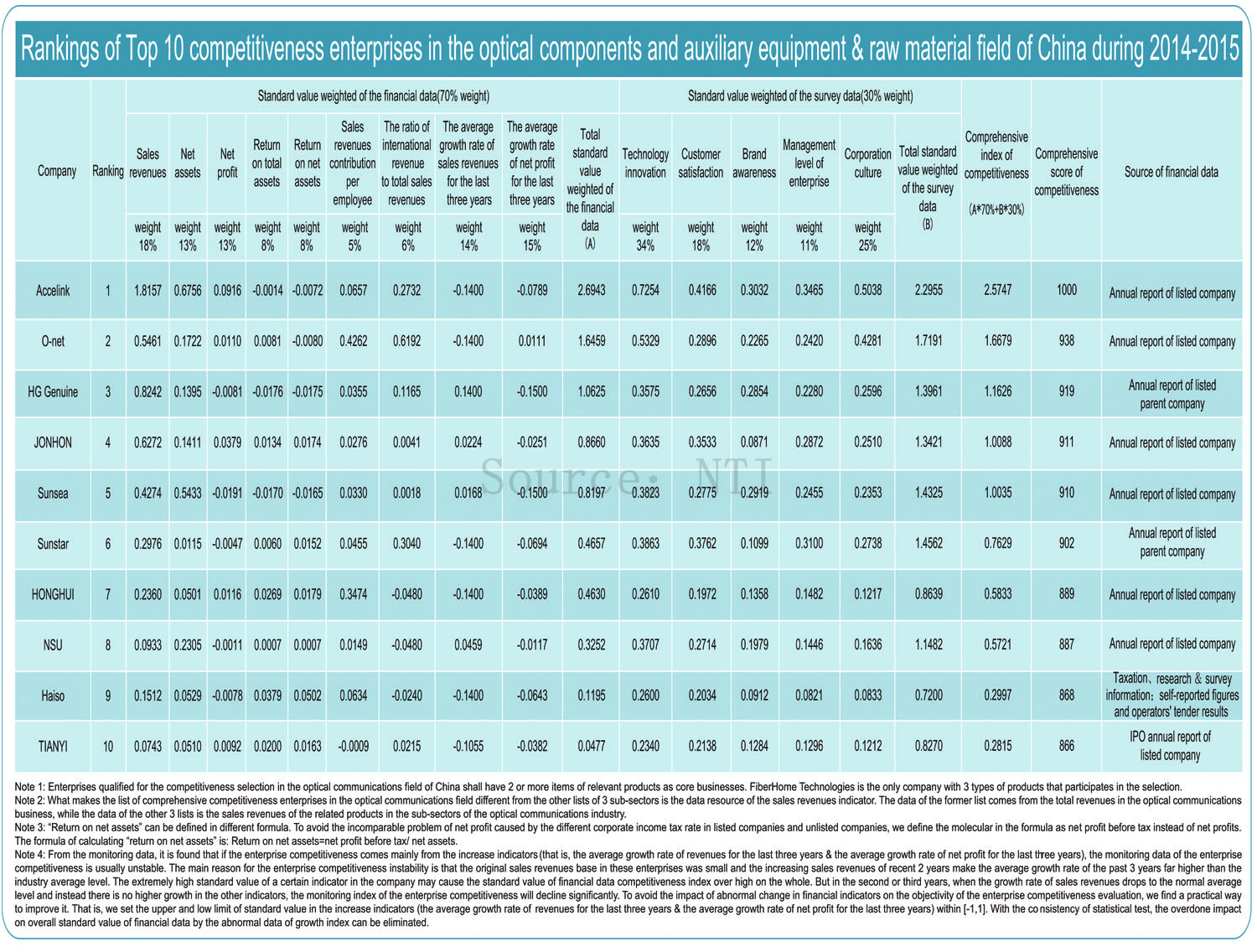

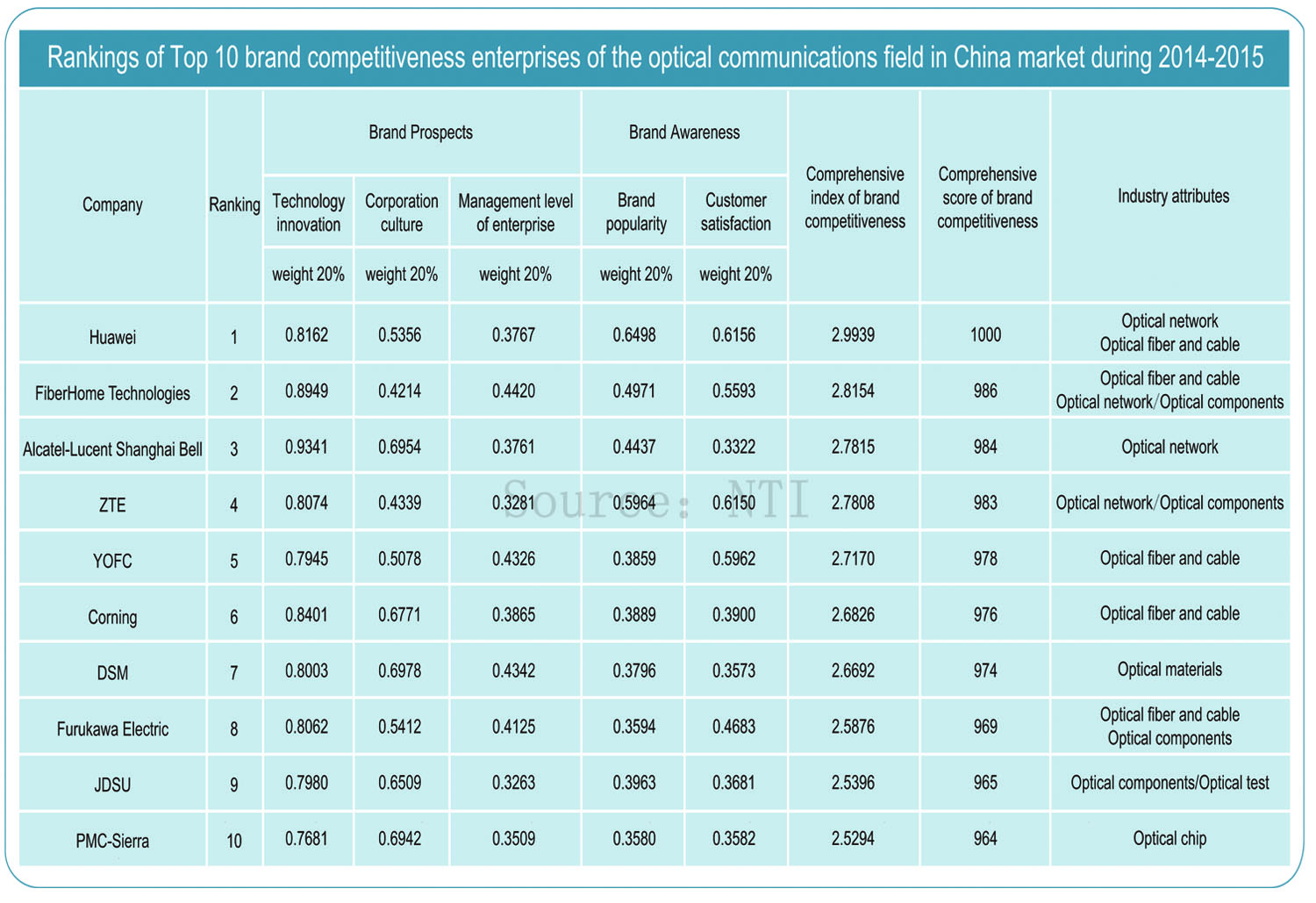

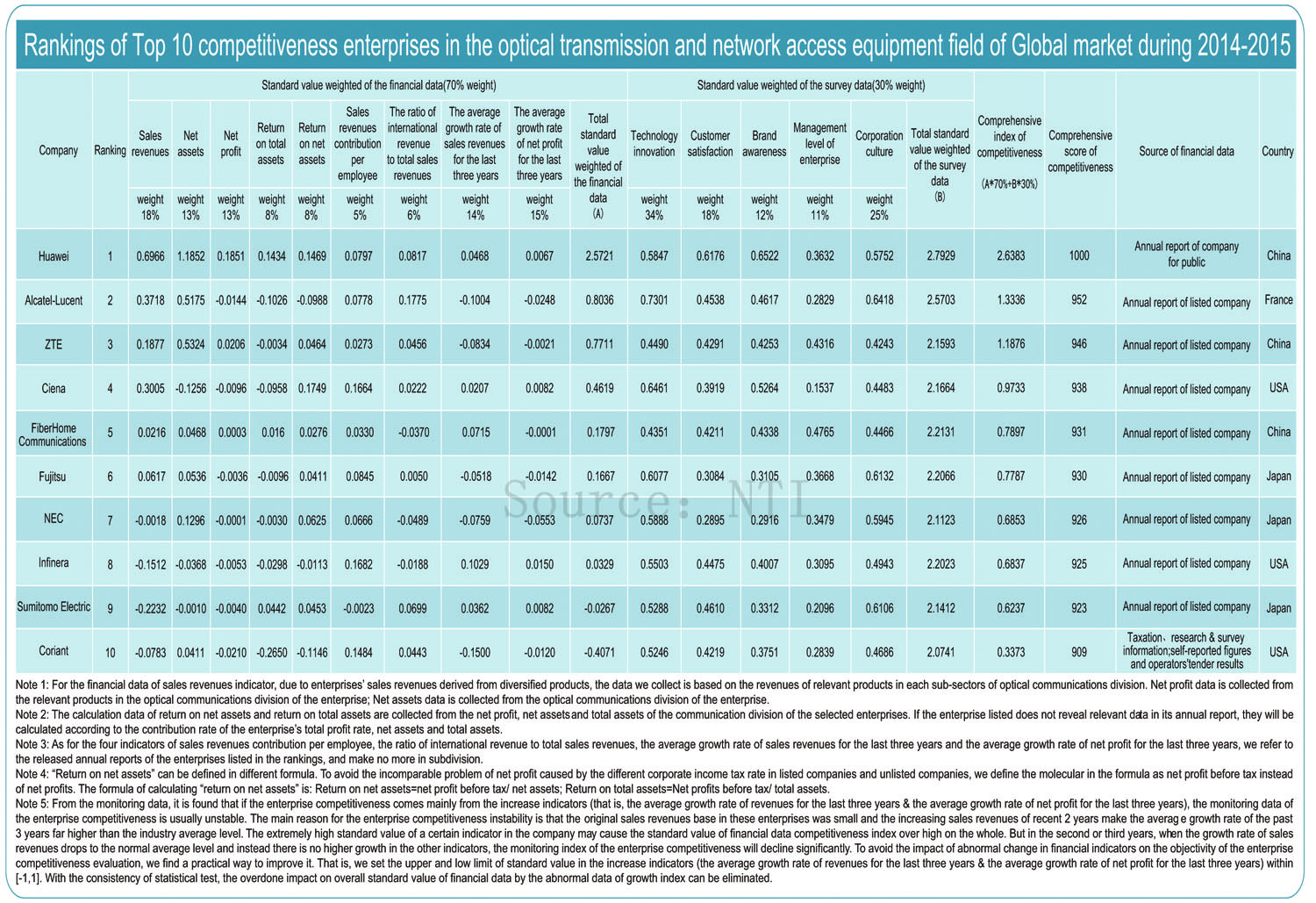

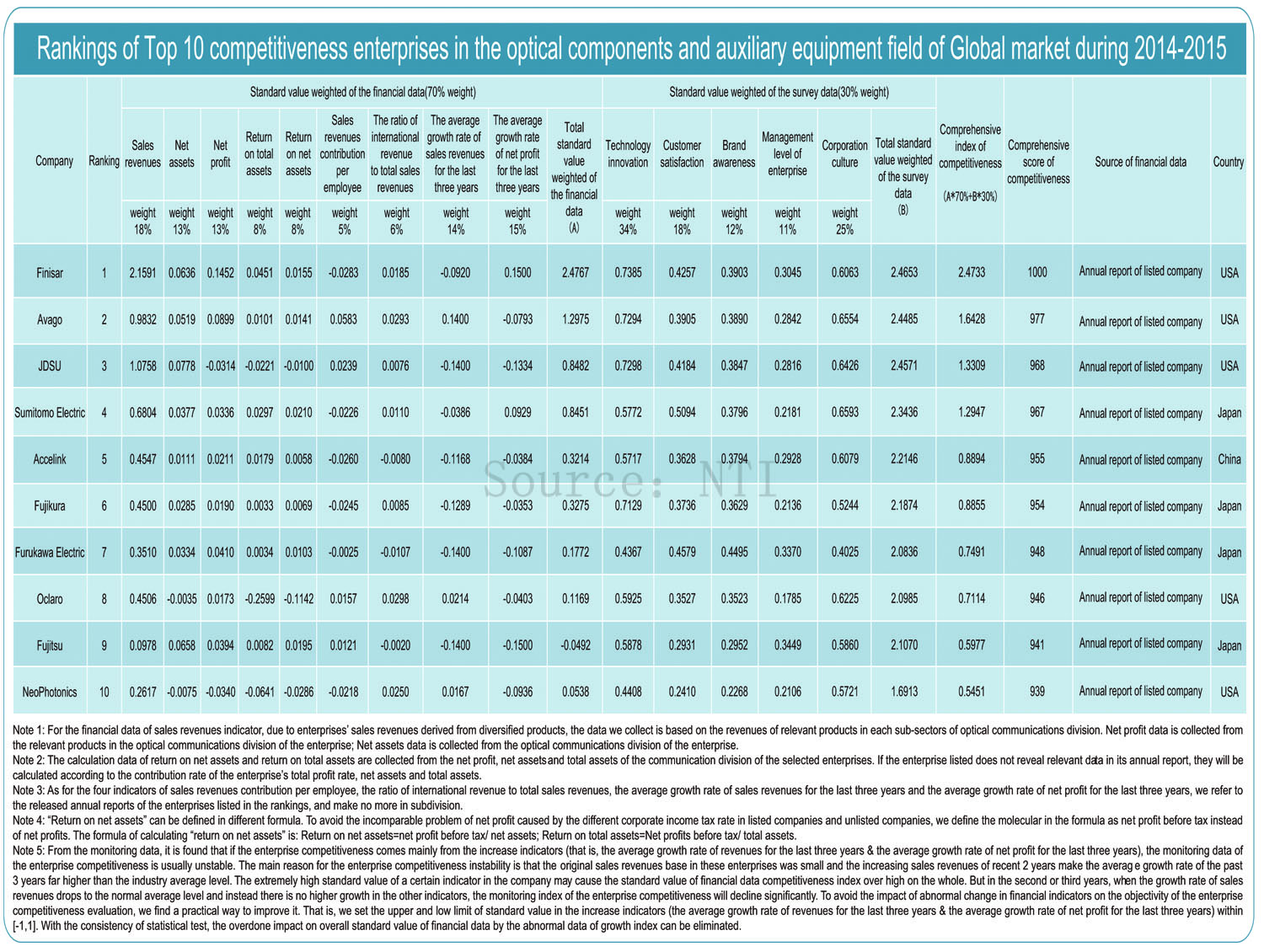

1106 Preface • Work summaryThough recovering of the world economy is still going on more slowly than expected in the past year, the global optical communication market is gradually becoming better in the whole year of 2014. With booming of business application in the field of internet and mobile internet, optical communication industry in our country is also developing fast and domestic demand for optical fiber and cable is maintaining a growing trend. With the strategy of "Broadband China" deeply promoted and "Internet Plus" promoted to be both a national strategy and top design idea from a hot word in the industry, the concept of "big data" has obviously transferred into business value, initiating a new circle of innovation in the ICT market. In the "new normal" phase, optical communication enterprises in our country is embracing a new round of development opportunities. Chinese market has become a major force to facilitate development of the global optical communication industry. From exporting of simple products in the past to building factories overseas and construction of local service team nowadays, internationalization of optical communication enterprises is now stepping from internationalization of market and resource in the past to a new stage of complete state of combining the internationalization of brand, producing and service. According to Competitiveness Report for Optical Communication Enterprises 2015, by following and supervising the financial data and indicators in the annual report of optical communication enterprises in the 2014-2015 year, it has been found out that growth in the optical transmission, optical components and optical communication fields have achieved comparatively big growth and optical fiber and cable only marks a small drop when viewing from the weighted average value of the directly calculated hard indicators and basic data of the top 10 competitiveness enterprises( by comprehensively weighting the sales revenues, net assets, net profits, return on total assets, net return on net assets, sales revenues contribution per employee, the ratio of export revenues to total revenues, average growth rate of sales for the last 3 years and average growth rate of net profitsfor the last 3 years).This fully shows that even our national economy has stepped into a "new normal" phase in this year, the optical communication enterprises remain a sound development status, which is benefitted from mastering the development trend of a series of national strategies by those enterprises. It has been 9 years since Network Telecom Information Institute concentrated on competitiveness analysis on Chinese optical communication enterprises. By integrating analysis in the past 9 years and exemplified by the top 10 competitiveness enterprises in the optical communication industry and its branches in China, as shown by table 1 and figure 1, we find that the competitiveness in the field of optical transmission, optical components, optical communication and optical fiber and cable generally appears a fluctuate upgrading trend and develop comparatively fast in recent two years, which is a quite promising achievement.

Specifically, by comparing the range, we find that the dispersion degree in the field of optical transmission and optical fiber and cable is comparatively huge and the figure shows big distance in competitiveness in the two; while dispersion degree in the optical components field is relatively small, which evidences that this field generally appears a tight and harmonious development trend.

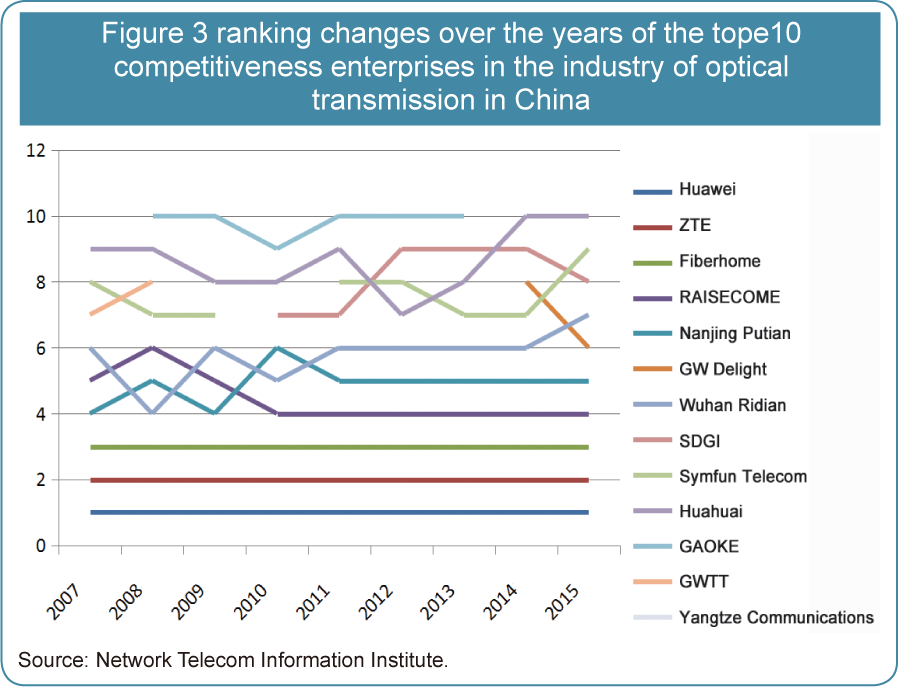

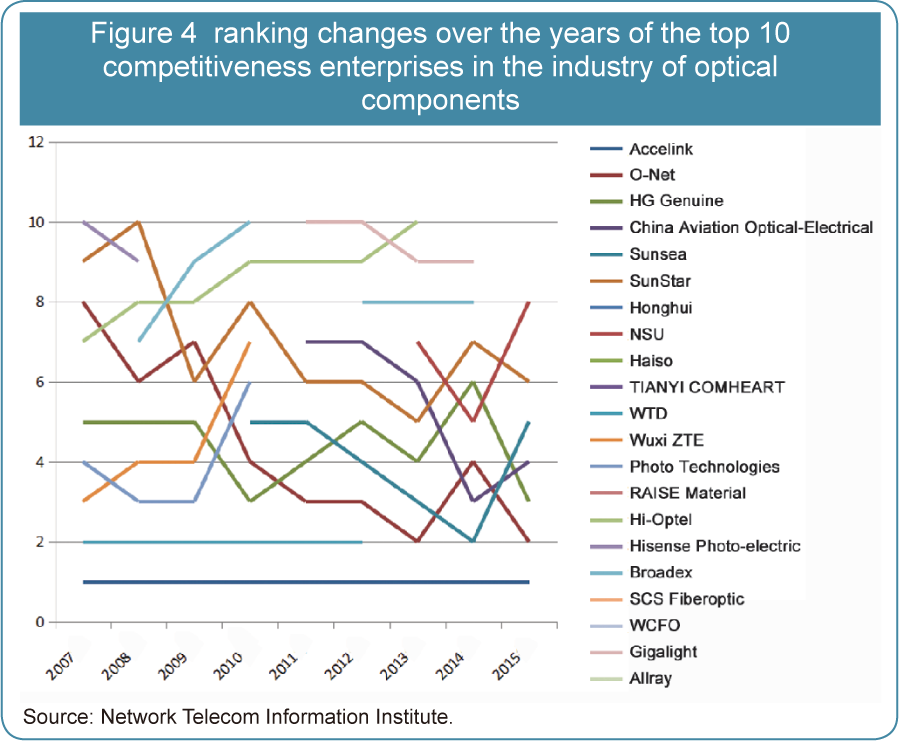

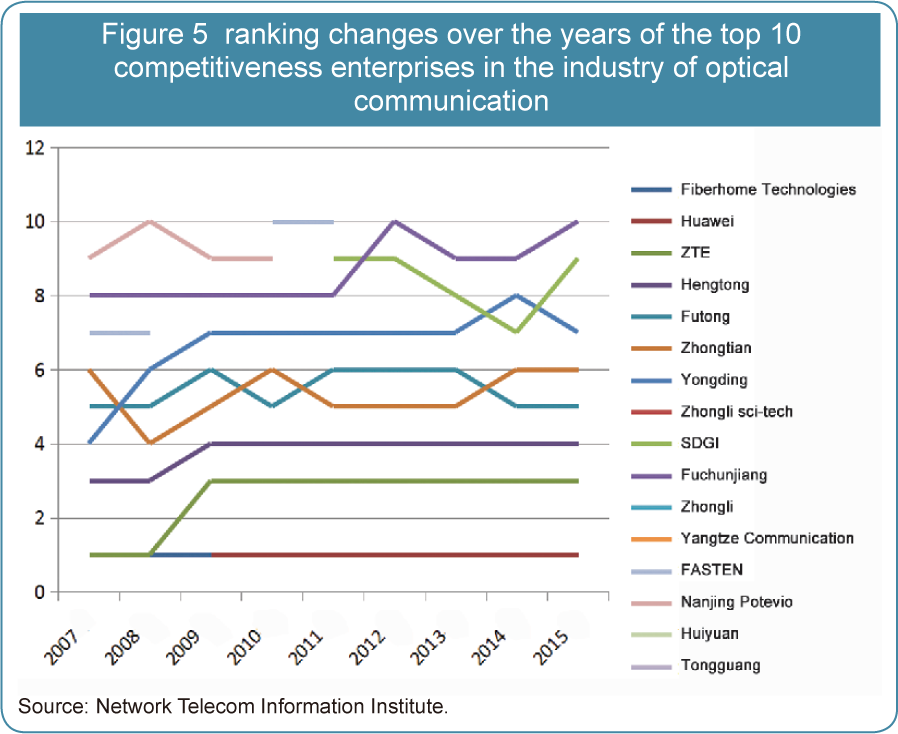

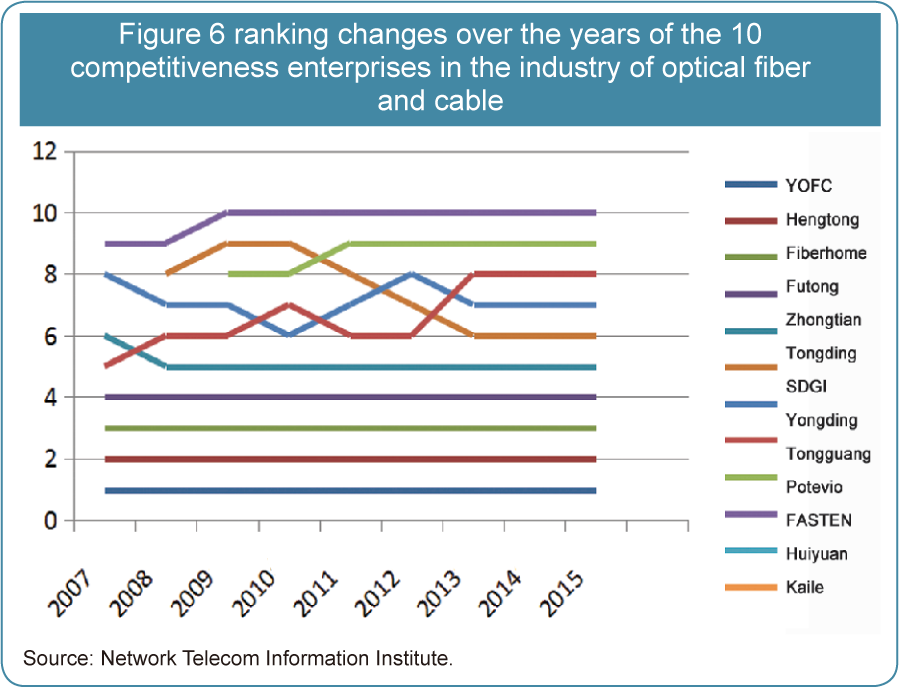

To step more deeply into each company of the top 10, which are the leaders in the optical communication industry and its branches, we find that optical transmission and optical fiber and cable field are relatively stable, especially in the latter while the former is relatively more changeable in recent 9 years. The big change and fierce competition can be evidenced by 21 enterprises listed in the ranking in the past 9 years. Generally, change range in the top 5 enterprises is not so obvious while indecisiveness in the industry is comparatively high. However, the field of optical components is particular to a certain degree except the case when Accelink Technologies ranks at the top all through the year while competition in other several top enterprises is fierce, the change range will be huge.

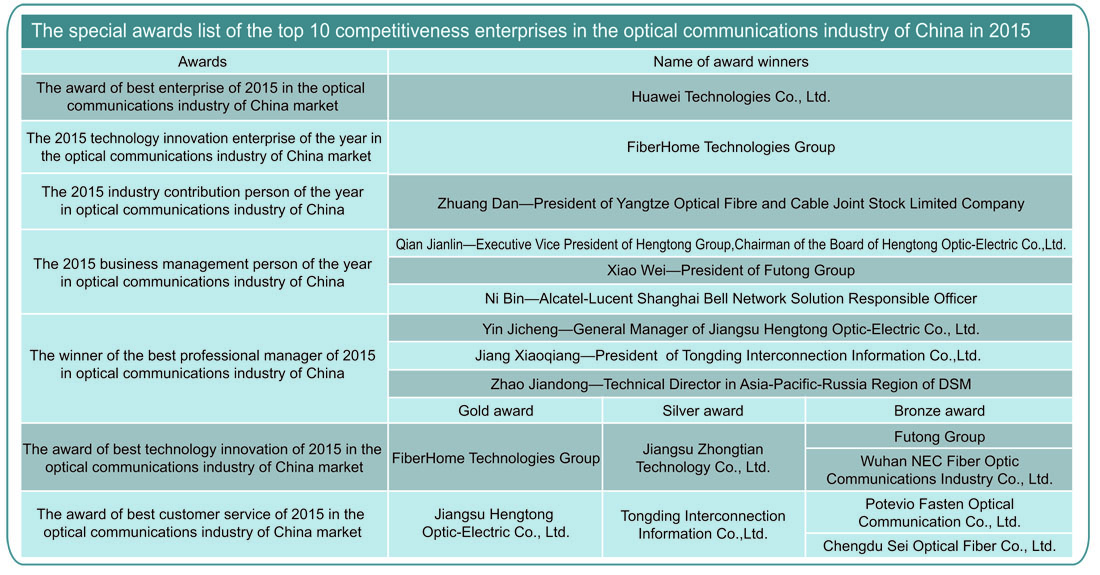

Looking back development status of the optical communication industry and its branches in recent 9 years, generally, we can see an upgrading trend and that this industry is pursuing prosperity and going the outside world step by step. Certainly, some problems concerning development also exist. In October 2013, May 2014 and August 2015, Network Telecom Information Institute has made questionnaire investigation for optical communications in China, aiming to know about how enterprises in this field judge the economic state currently and in the medium and long term. Through investigating of the survival state and environment of the optical communication three times in recent 3 years, we come to conclusions as below: (1) Pressure of rise in price of the raw material is still heavy; according to investigation data on judgment of price change of the raw material in the future of the optical fiber communication enterprises, most optical communication enterprises is not optimistic about the variation trend of the price of raw material in the future. More than half, 69.3% of the optical communication enterprises believe that the price of raw material in the future will maintain rise and 23.3% of the enterprises insist that the price in the future will remain the current price level while only a few enterprises considers that the price will keep falling down, occupying only 2.4% of all the enterprises. (2) The problem of difficulty in applying for loan has been alleviated; the support capital gained by optical communication enterprises via applying for loans in 2014 is not optimistic but the problem of difficulty in applying for loan has been alleviated: obtaining loans as a common difficulty is a common for most enterprises, occupying 39.68%; obtaining loans as the hardest and relatively difficulty for enterprises respectively takes up 13.28% and 26.55% while those find it easy or not a problem to obtain loan accounts for 13.56% and 6.93% respectively. (3) Optical communication enterprises varies great in judgment on export; generally speaking, there is great difference in judgment on export of the next year for those enterprises. 39.47% of them are optimistic while 38.24% of them are pessimistic, almost accounting for the same ratio. Therefore, there is great uncertainty in export trend of optical communication products in the future and judgment on export is obviously different for different enterprises. (4) That the cost of production factor increases too fast has become the main factor affecting business of optical communication enterprises and currently it has become the dominant fact affecting business of enterprises in this field. In the process of investigation, in terms of selecting the current comparatively big factors affecting business, most optical communication industry has chosen too fast growing of the cost of labor forces, occupying about 70.06% of all the enterprises, the maximum proportion; and those choosing too fast growing of the price of raw material is less than those choosing labor forces, accounting for 65.08% of all while those choosing increasing of risk of foreign exchange fluctuation takes up 49.86%. Influence of too strict environmental regulation on business operation is the minimum, taking up 31.60%. (5) Short supply of medium and high ranking of talents has become one of the bottlenecks for optical communication industries; and generally speaking, it is difficult for optical communication enterprises to recruit various levels of staff. Enterprises having difficulty in recruiting technicians, senior management talent and engineers respectively takes up 54.19, 54.11% and 48.13%, showing serious market structural unemployment. In the process of selection which lasts for 9 years, we have witnessed various opportunities and challenges that optical communication industry has gone through step by step till occupying 60% of the global market share currently, from weak to strong. Globally speaking, Huawei, YOFC (Yangtze Optical and Cable Joint Stock Limited Company), ZTC (Zhongxing Telecommunication Equipment Corporation),Hengtong and FiberHome rank from 1st to 5th in sequence respectively in each field and they are pride of Chinese optical communication industry. We hope that more Chinese optical communication enterprises will rank global top 10 in the near future. In the process of monitoring competitiveness of optical communication industry in the previous 9 years, we have accumulated lots of datas and materials of those enterprises and improved our supervising methods. We have decided to compile business index and forecasting and early warning system in the field of optical fiber and cable industry in 2016, to issue the index and forecasting and warning system in each season, in half a year and in one year respectively. The aim is to help enterprises in the optical fiber and cable industry know about the current development status of the industry and to forecast trend in the future, achieving a signification of guidance and a practical value. This system applies industrial business index, warning signal system and rough set — a neural network model to monitor the optical fiber and cable industry. Based on constructing the system of monitoring index in this industry and making pre-processing, time difference related analysis method and peak-to-valley correspondent method are applied to divide the index in three groups: those in the leading position, those almost simultaneous and those behind. By combining theoretical analysis and practical condition in the optical fiber and cable industry, 45 indexes are initially selected out, mainly classified in four parts: macro-economic index affecting development of the fiber and cable industry, equipment supplying index, index in the upper and down chain of this industry and core index in this industry itself. After making pre-processing and adjusting the index, it is finally confirmed that 10 index are in the leading position, 4 index are simultaneous and 4 index lagging behind (please refer to the 4th page of this report to see the relevant index, system instruction and calculation methods). By compiling business index for the optical fiber and cable industry, development status of this industry can be comprehensively described, the business fluctuation range can be reflected and the periodical fluctuation trend can be forecasted. The leading index are used to forecast the trend of change in the industry, the simultaneous index are used to reflect the current development status and index falling behind are used to judge whether some state of this industry has started or come to an end, which can be referred as evidence to make revision to the previous circle of polices. As is evidenced by our initial simulation operation, the leading business index surpasses the simultaneous index for about 2 to 3 months in average and the index behind falls for 2 months. Then, by combining 3σ principle and experts' experience to build critical value of dividing the warning index, a warning signal light system is established. In the next step, the indication in each phase and the comprehensive warning index state are marked in a way similar to the traffic signal lights, thus, the whether the optical fiber and cable industry is hot or not can be directly indicated and trend in the coming season or longer term of this industry can be forecasted with warning degree. Therefore, the aim of warning the fluctuation of this industry could be achieved and this can be used as guidance for making decisions accordingly. At last, on behalf of all members of the review group of "Top 10 Competitiveness Enterprises in the Optical Communication Field of China & Global market during 2014-2015", may I express my gratitude again to all colleagues' help and support for the selection events in the past 9 years! Thank you!

|

Ranking of "The Top 10 Competitiveness Enterprises in the Optical Communications Industry of China & Global market during 2014-2015" |

|||||||

|