Preface • Work summaryOver the past year, the global communication market has been growing vigorously. Around the world, the construction of optical fiber networks, fiber to home, large data centers, etc. has been promoted, and the demand for fiber optic cables, optical transmission, optical devices and other fields has been rising. However, due to the further improvement of China's 4G construction and the fact that 5G has not yet entered the obvious dividend period, the growth rate of global optical fiber and cable market in 2018 has slowed down compared with that before.

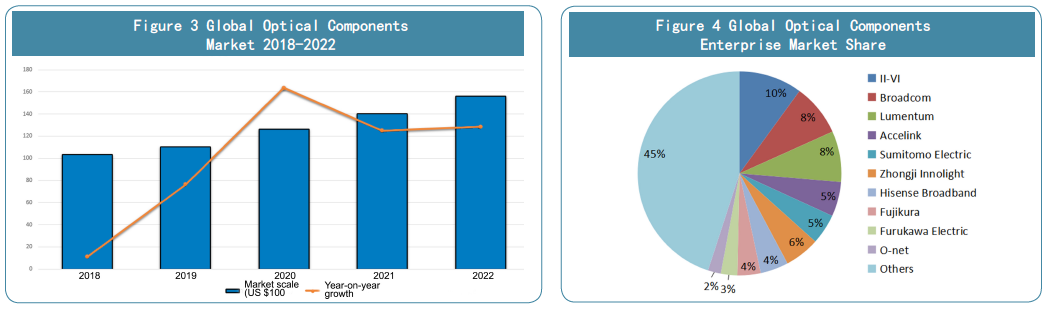

Viewing from the entire global optical transmission and network access equipment, HUAWEI stabilizes its leading position with competitive score exceeding second Nokia of 71 points. Ten companies in this list come from five countries: Finland(Nokia), Japan(Fujitsu, NEC, Sumitomo Electric), the United States(Ciena, Infinera), China(Huawei, ZTE, FiberHome), and Germany’s(ADVA). HUAWEI ranks first by sharing 21% of global optical transmission and network access equipment. Nokia locates No.2 with its 13% of market share. Ciena is listed No.3 with its 12% market share. FiberHome is in No.4 location, with market share of 13%. And Fujitsu is in No.5 location with its market share of 7%. ZTE falls to sixth place due to the injunction of United States. NEC, ADVA, Infinera and Sumitomo Electric occupy 4%, 3%, 5% and 1% market share respectively. Global optical transmission technology is the new development direction of information transmission technology, and China is the largest optical communication market in the world. HUAWEI, ZTE, FiberHome and other enterprises have become the leading enterprises in this industry after years of efforts. Figure 2 is the market share of global optical transmission and network access equipment manufacturers.

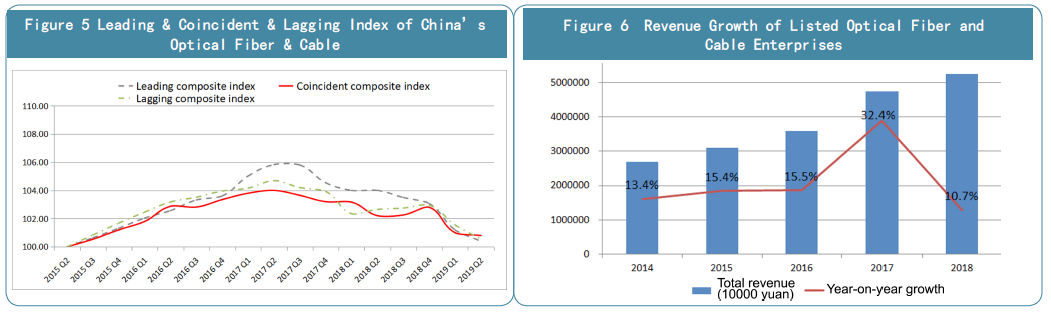

The global market size of optical components in 2018 is about US $10.3 billion, increases less than 1% than last year. While the global data center optical module market scale in 2018 is about US $3.7 billion, with a year-on-year growth of 12.12%.In 2018, with the alteration of new technology, enterprise merger and acquisition, and developing markets, important changes have taken place in the global optical components market, including technical direction, product selection, access mode of developing markets, etc. As shown in Figure 3 is the scale of the global optical components market from 2018 to 2022: Among the top 10 optical components manufacturers in the world, three are from the United States, three are from Japan, and the remaining four are from China. This proves that Chinese companies have made great progress in the field of optical components and are narrowing the gap with United States and Japan. Accelink is still in the fourth place this year, the same ranking as last year, while Zhongji Innolight, Hisense Broadband Multimedia, and O-NET ranks 6th, 7th, and 10th, respectively. II-VI, Broadcom and Lumentum ranked in the top three with comprehensive competitiveness scores of 1000, 993 and 976 points respectively, and there was no significant difference in competitiveness. In terms of market share, II-VI, the first-ranked company, occupies 10% of the market share, while Broadcom and Lumentum, the second-ranked and third-ranked companies, occupy 8% and 8% respectively. Accelink, the fourth company, occupies 5% of the market share, while Zhongji Innolight, Hisense Broadband Multimedia and O-NET, the other three Chinese companies, rank 6th, 7th and 10th with 6%, 4% and 2% of the market share respectively. Sumitomo Electric, Fujikura and Furukawa Electronic have market share of 5%, 4% and 3% respectively.

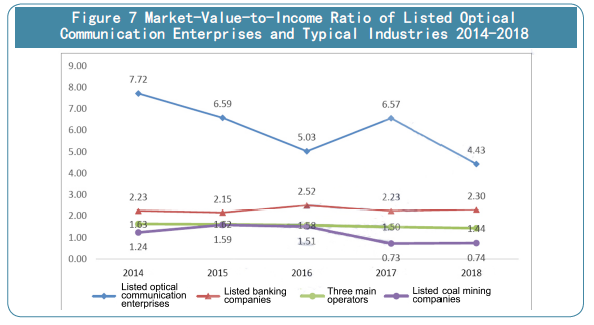

The revenue growth falls to 10.7%. In 2018, the revenue of listed optical fiber and cable enterprises has reached 50.551 billion, increasing by 10.7% than last year. From 2014 to 2017, the growth rate was 13.4%, 15.4%, 15.5% and 32.4% respectively. In

In addition, the new kinetic energy is expected to develop rapidly. 2019 is the pivotal year for 5G commercial deployment. The industry, research and application will work together to promote standards, R&D, testing and safety supporting work. By accelerating the maturity of the industrial chain, the application based on 5G will continue to innovate, which will directly benefit the fiber optic cable industry. From 2019 Q2 to 2019 Q3, based on the precipice decline of the industry in the first half of the year, the development leading index of China's optical fiber and cable industry shows a downward trend. In the next two quarters, the consensus index may slightly decline, but it shall remain at about 100.5, which is at the critical point of the boom transformation. Although the current China's optical fiber and cable market is significantly affected by changes in market supply and demand, it still faces great pressure in the short term. It is predicted that in the next two quarters (2019 Q4 and 2020 Q1), China's optical fiber and cable industry will continue to be in a downturn, with a range of 5%-15% slowing down. But in the future, with the launch of 5G large-scale network construction and data center, the industry outlook is bright with plenty of opportunities.

In the end, I’m honored to express my sincere gratitude to all partners in optical communication industry for their longterm help and support on behalf of all staffs of “The Annual Top 10 Competitiveness Enterprises in the Global/China Optical Communication Field”. Thank you!

|

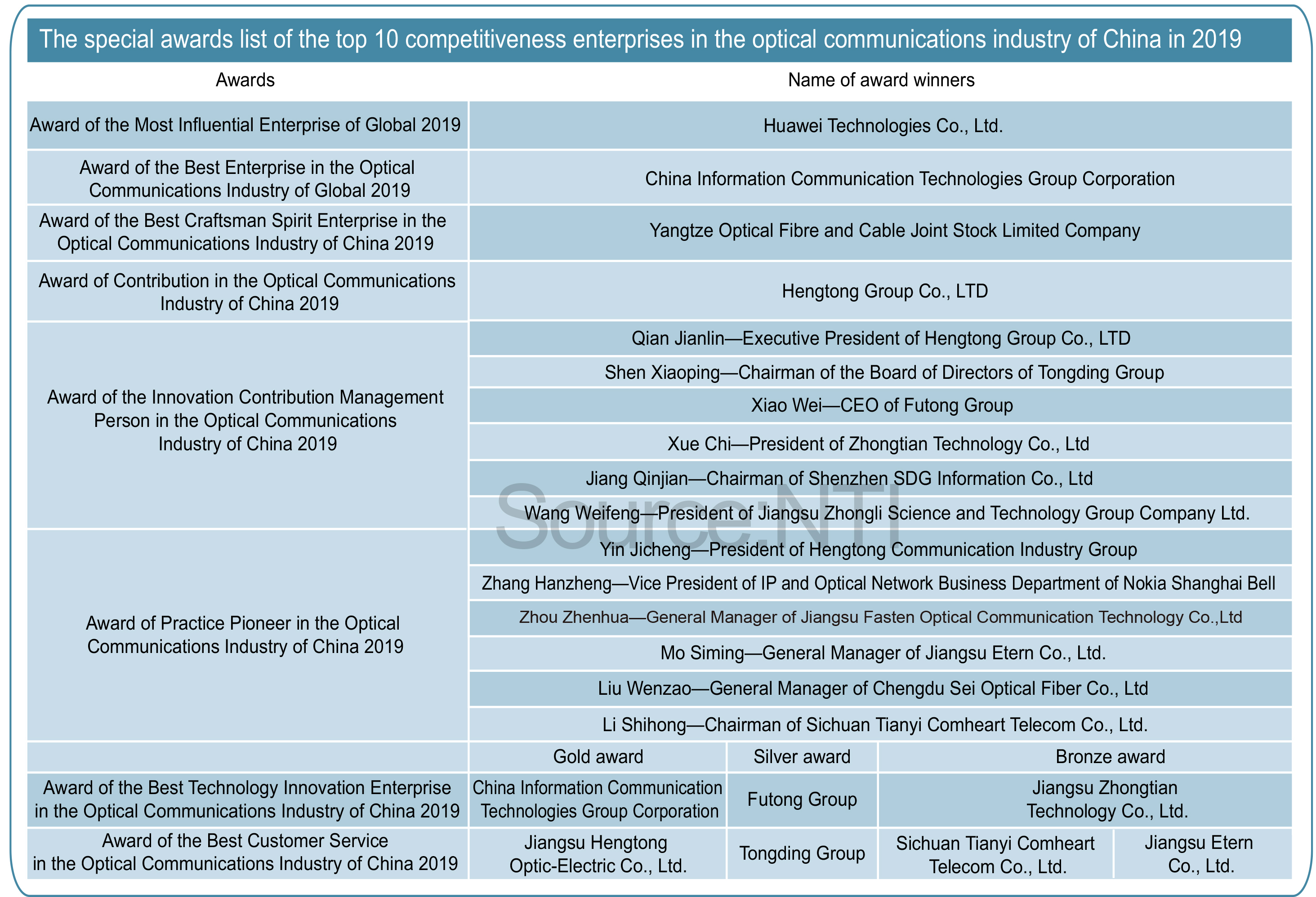

Ranking of "The Top 10 Competitiveness Enterprises in the Optical Communications Industry of Global & China market in 2019" |

|||||||

|