|

1613

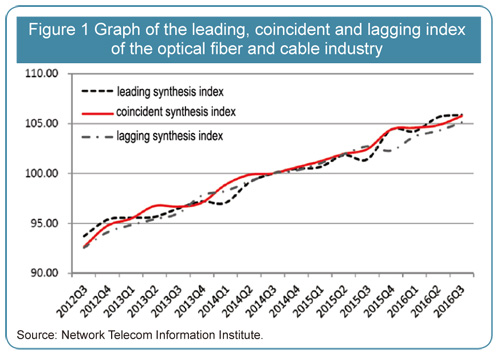

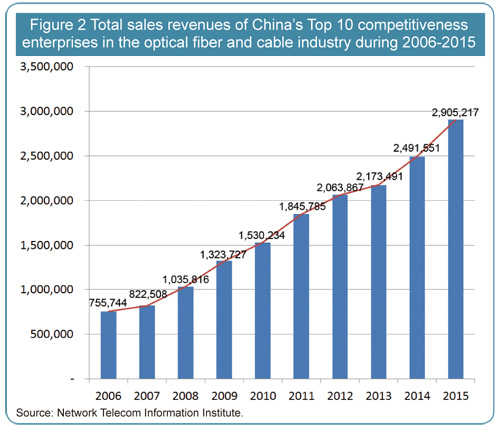

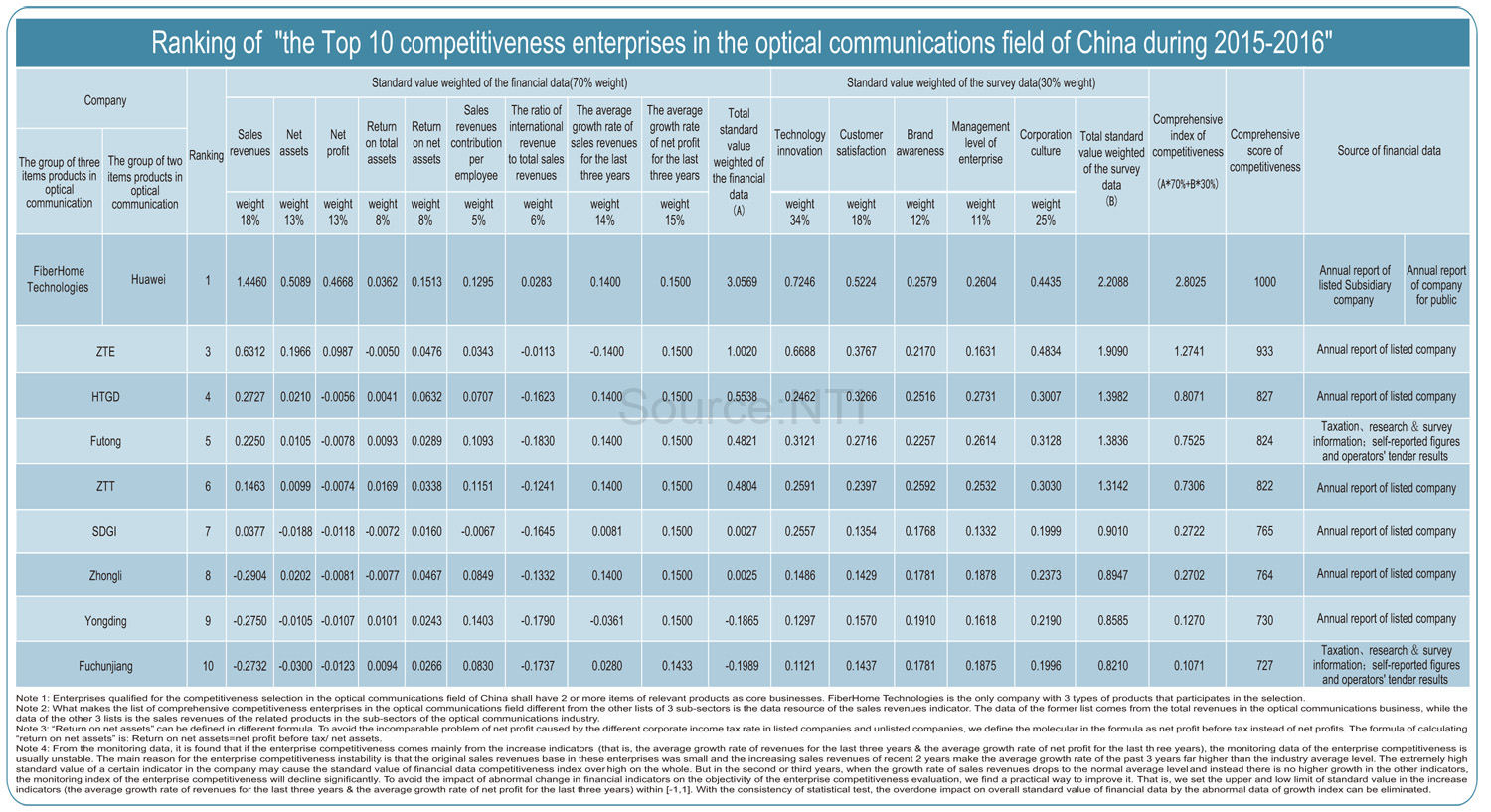

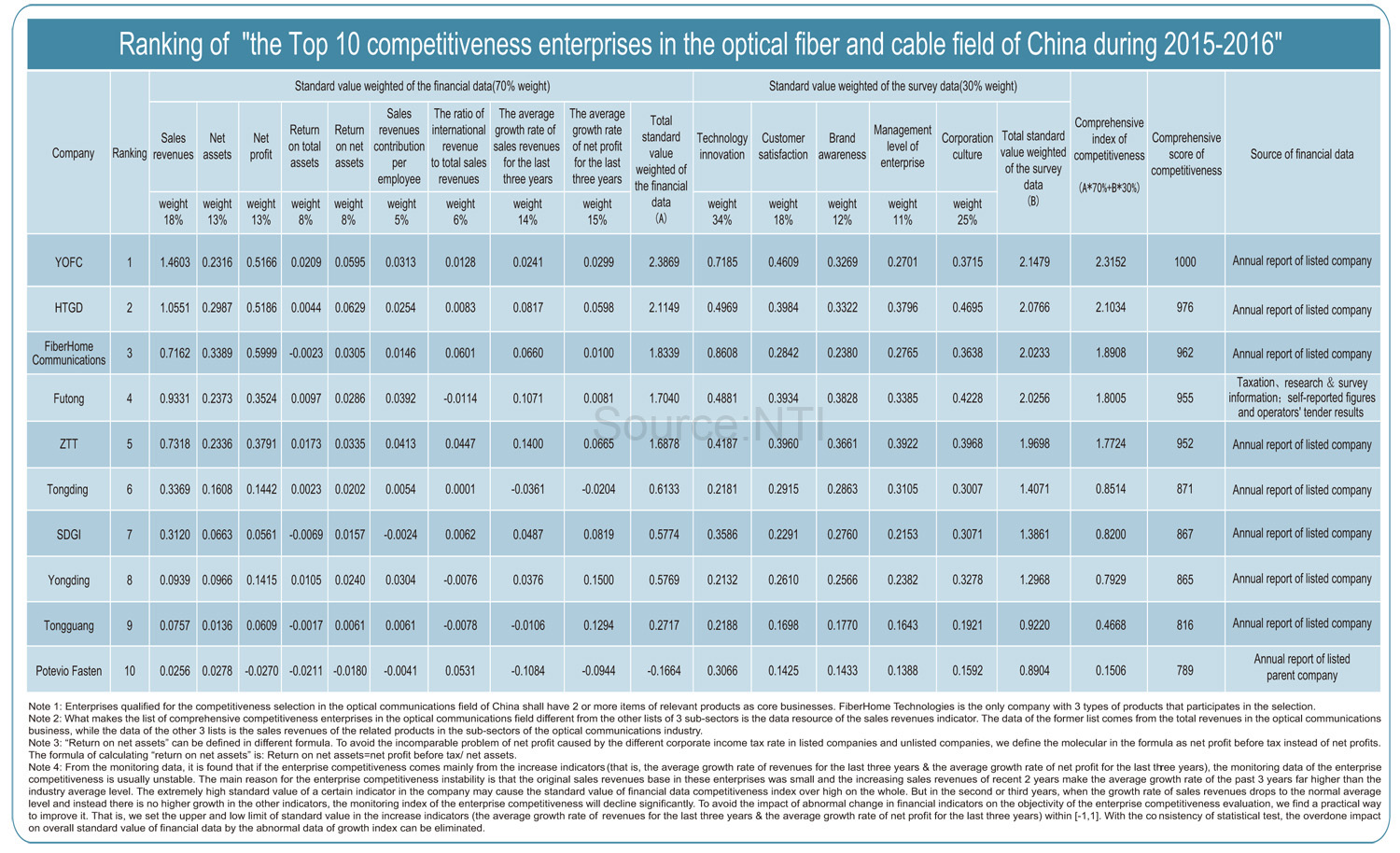

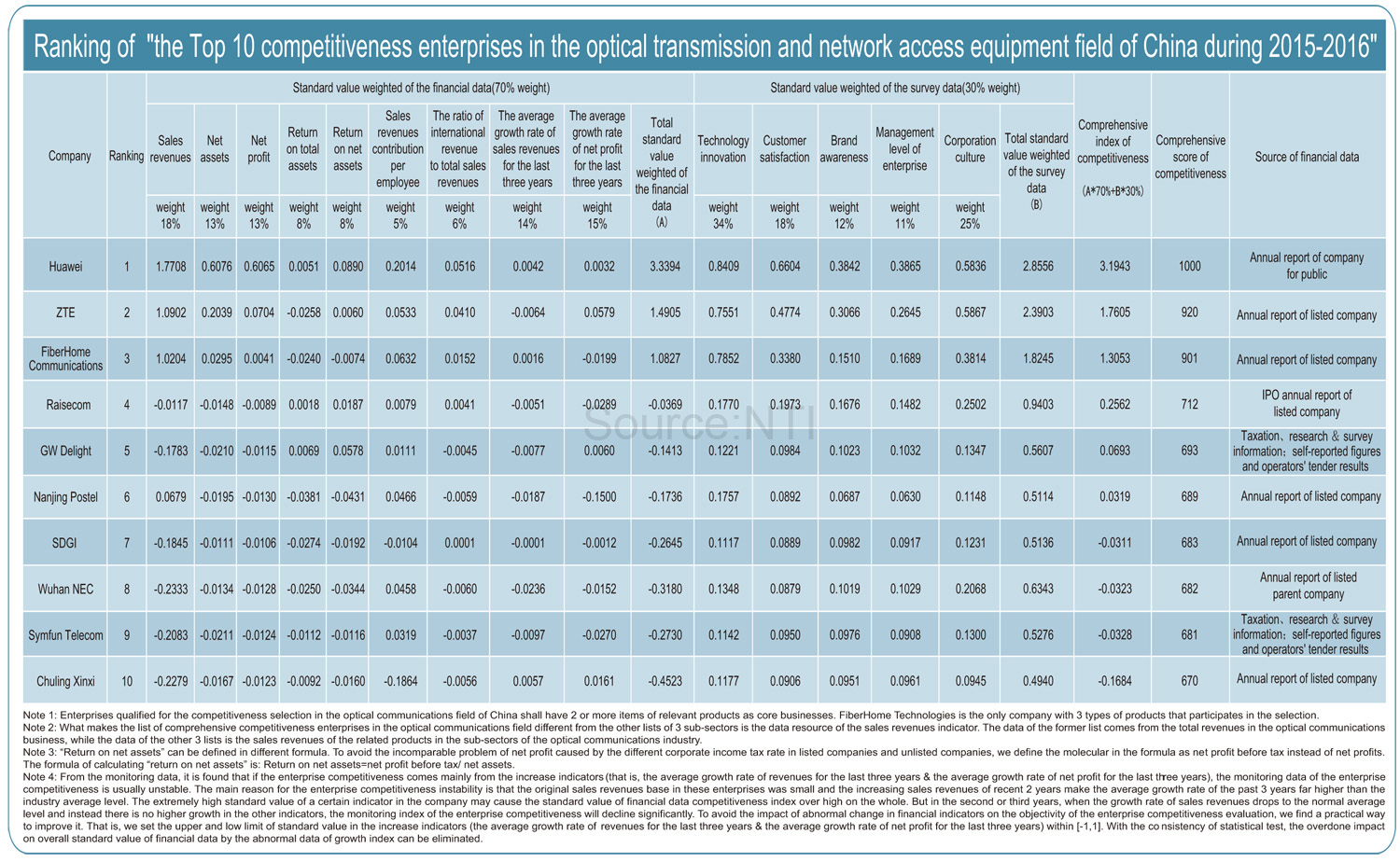

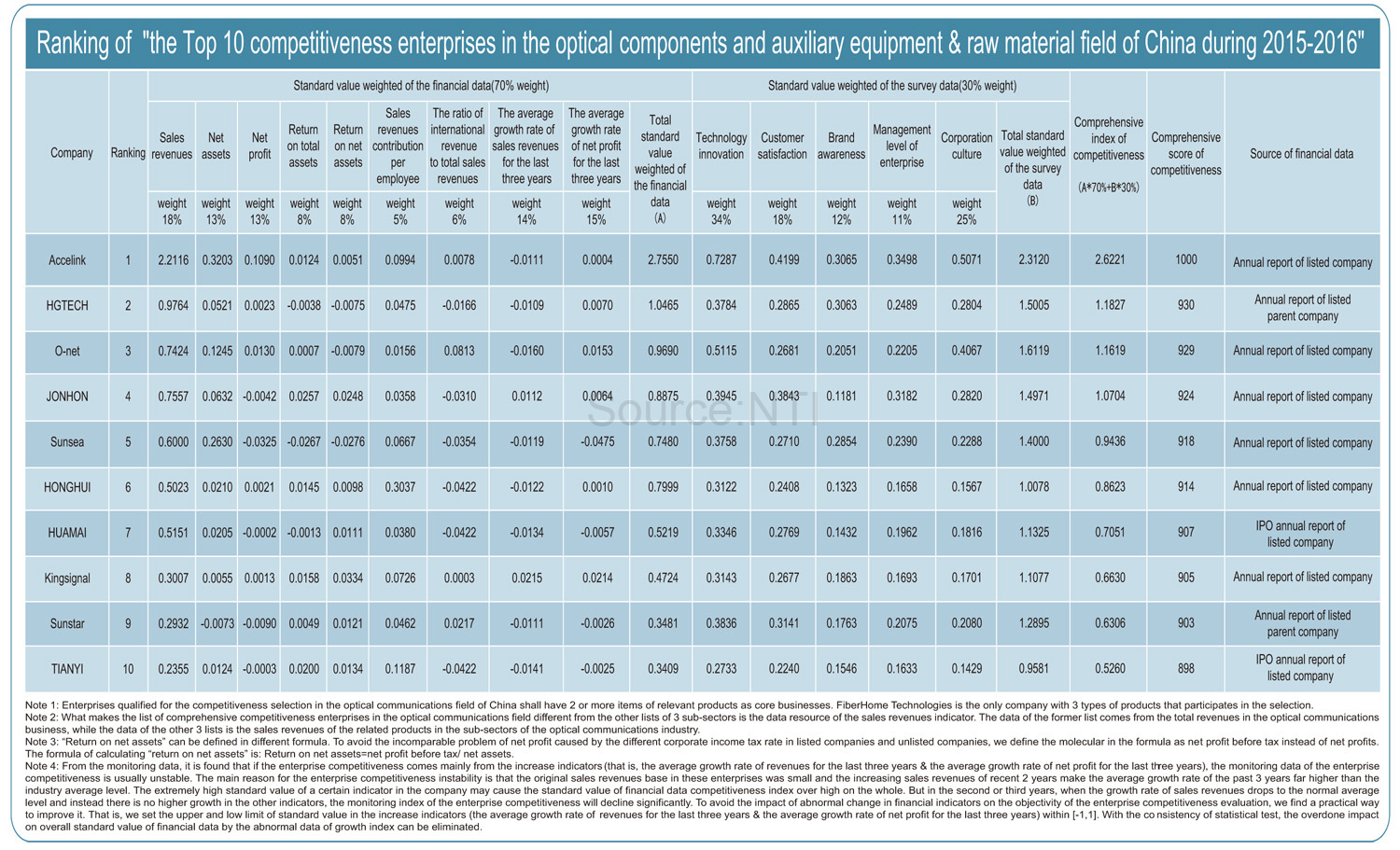

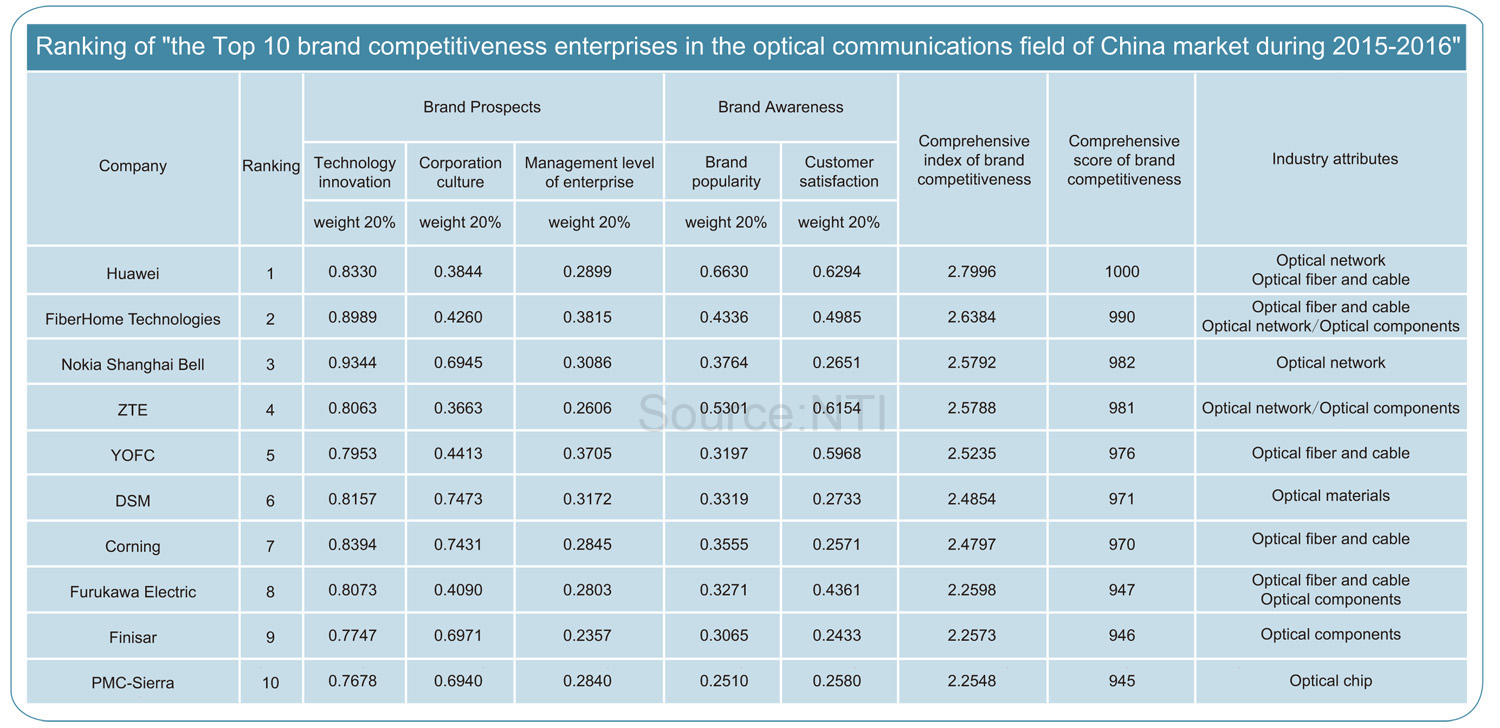

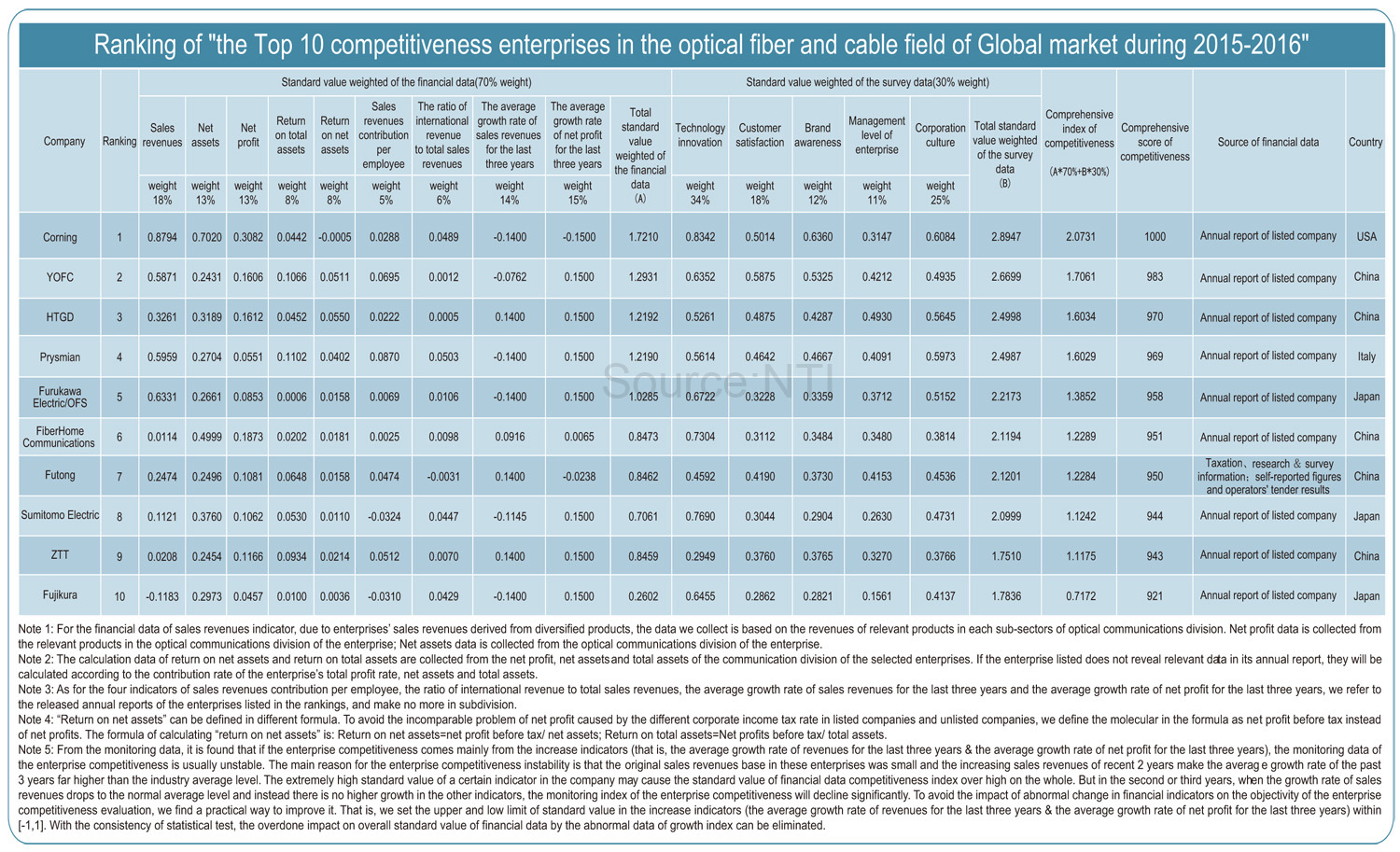

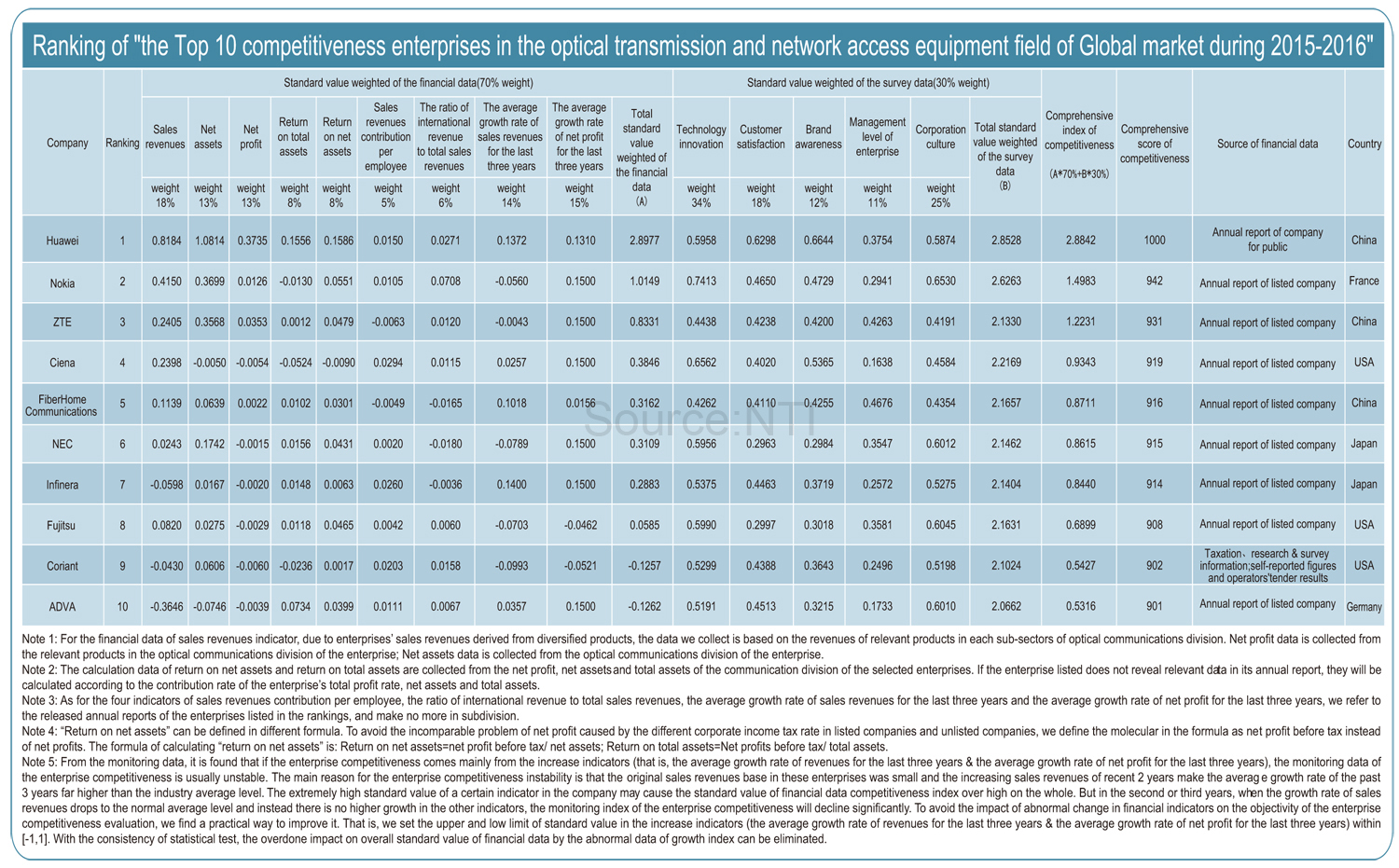

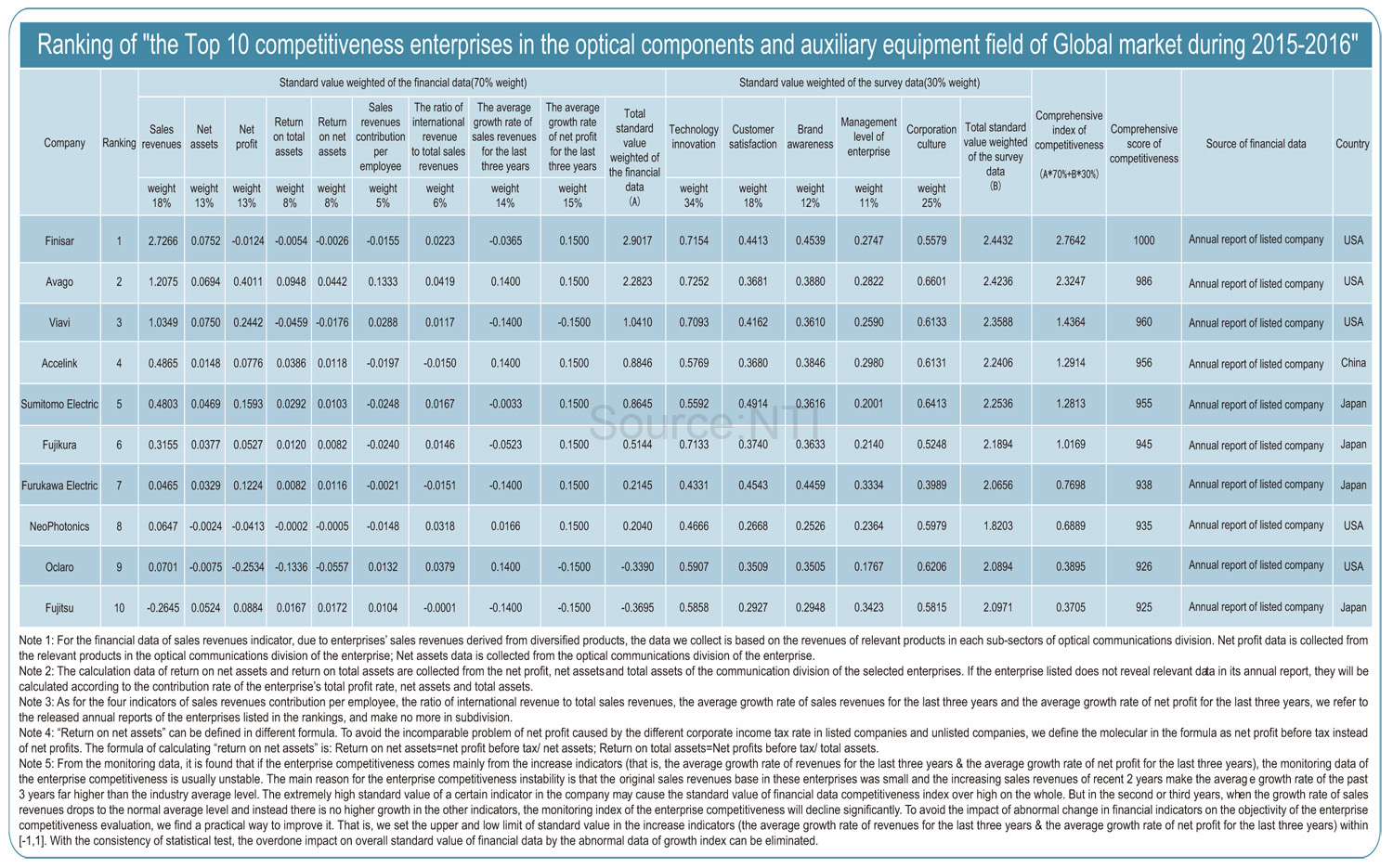

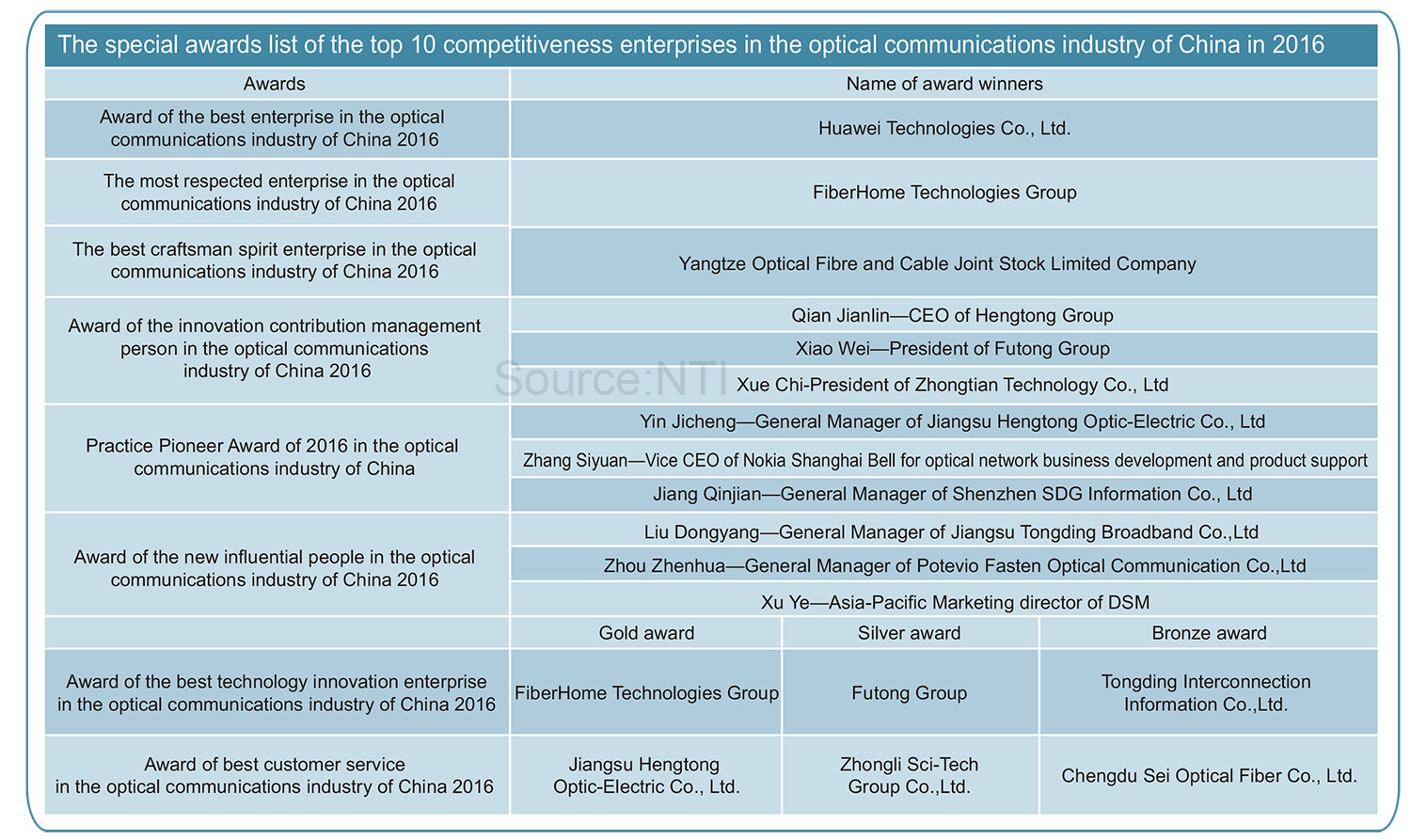

Preface • Work summarySince 2006, the competitiveness monitoring project among optical communications enterprises has gone through 10 years, during which we have witnessed the leap of competitiveness of many Chinese enterprises. 2015 was a fruitful year for the global optical communications market. A handful of optical communications enterprises all yielded satisfying results. With the full implementation of a series of favorable policies and strategies like "Broadband China" strategy, FDD licensing, "speed improving and tariff cutdown" policy and so on, most of the major optical equipment manufacturers, optical fiber & cable providers and optical component suppliers around the world enjoyed a period of booming demand. On one hand, the favorable policies inspired enterprises' enthusiasm for R & D and production; on the other, the rapid development of Internet of things (IoT), 4K video and other fields and the increasing demand for larger bandwidth will definitely bring a new round of development opportunity to the China and Global optical communications industry. As the first year during China's 13th Five-Year Plan period, the optical communications market in 2016 continued last year's strong momentum thanks to the booming broadband market in China, especially in the demand for optical fiber and cable,. With multiple favorable policies such as "Internet+", "Broadband China" and "New Smart City", more and more advanced technologies and research achievements will be applied in fields like information infrastructure construction, cyber security protection, and urban information management and so on. Such policies will also promote the transformation and comprehensive upgrading of China's optical communications industry so as to stimulate a new round of rapid development. Next 1-2 years remains to be a golden period for China's optical communications industry. It is estimated that in 2016, China's demand for optical fiber will reach 220 million to 248 million fiber km. For 10 years, we have witnessed how China's optical communications industry develops step by step to today's occupying more than half of the global market share after going through lots of opportunities and challenges. The results of the 10th ranking event of Top 10 competitiveness enterprises in the global optical communications market during 2015-2016 fully embody the competitiveness situation among enterprises in different fields of optical communications. Huawei, Corning and Finisar still take hold of the chief positions in fields they belong. Except for optical component manufacturers, Chinese optical communications industry shows strong competitiveness both in fields of optical fiber & cable and network transmission with 5 and 3 Chinese enterprises listed in the Top 10 competitiveness enterprises respectively. In terms of the domestic market, Huawei, ZTE and Fiberhome Communications still occupy the main optical transmission market; whereas in the optical fiber and cable market, YOFC, HTGD, Fiberhome Communications, Futong and ZTT hold the Top 5; in the optical components field, the gap between Accelink (1st) and the second has further widened to 70 points. Accelink's competitive edge is quite obvious. It is worth mentioning that in this year's competitiveness rankings, HTGD raised to the 3rd place in the Top 10 competitiveness enterprises in the optical fiber and cable field of Global market; ZTT, for the first time, get listed among the world's Top 10. In the optical components field, Accelink ranks 4th in the world's Top 10, up 1 position. It is glad to see that among the Top 10 competitiveness enterprises in the optical fiber and cable field of Global market, Chinese enterprises have accounted for half, which fully shows their strong competitiveness. To better serve China's optical fiber and communications industry, Network telecom Information Institute started to compile the prosperity index for China's optical fiber and cable industry early at the end of 2015. By selecting a series of comprehensive index that are clearly correlated with the periodic fluctuation of China's optical fiber and cable industry, and by using statistical methods, Network telecom Information Research Institute strives to comprehensively reflect the current situation of China's optical fiber and cable industry, to effectively monitor its development trend and to scientifically predict its future. Moreover, it provides an important reference for industry analysis, policy making, policy evaluation, and so on. The prosperity index of the optical fiber and cable industry in China is classified into 3 types: the leading index, the coincident index and the lagging index. The coincident index can comprehensively reflect the overall situation of the optical fiber and cable industry while the leading index helps predict the industry's future development. Prosperity index refers to the boom degree of a certain industry. It fluctuates up and down around the critical value 100. If prosperity index of a certain industry is higher than 100, it indicates that the industry is in a state of rise or improvement compared to the base period (a point in time used as a reference point for comparison with other periods). Contrarily, if this number is lower than 100, it indicates that the industry is in a decline of deteriorating state.

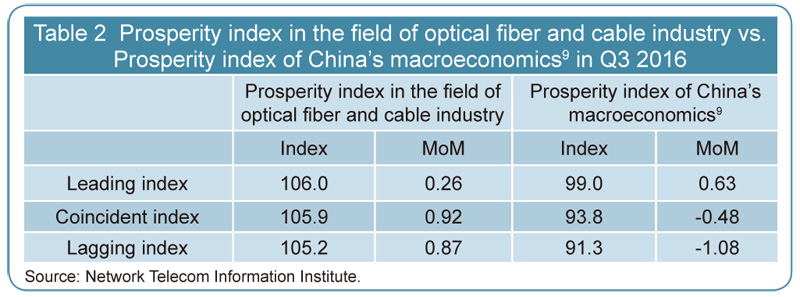

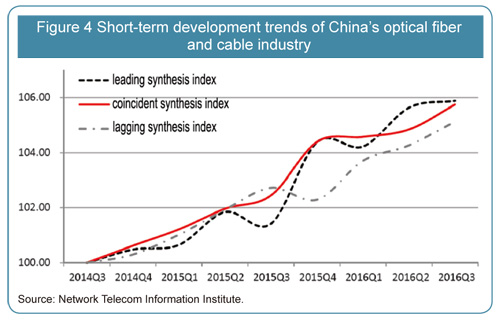

Through the analysis of prosperity index of China's optical communications industry, we can conclude that the industry is still in fast development. Taking Q3 2016 as an example, the coincident synthesis index of China's optical fiber and cable industry is 105.9 (Q3 2014=100, the same below), up 0.92 points month-on-month, which is very fast, the leading synthesis index is 106.0, up 0.26 points month-on-month, growth speed slowed. The lagging synthesis index is 105.2, up 0.87 points. Both leading and coincident index are in the rise, which embodies that China's optical fiber and cable industry will keep booming in the future.

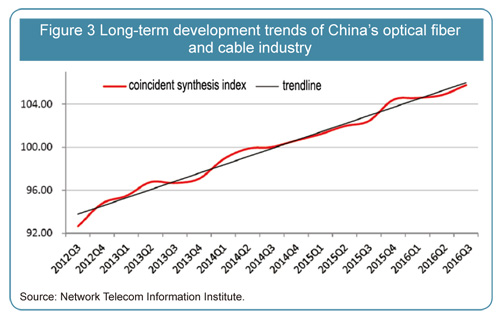

By comparing the prosperity index of the optical fiber and cable industry with that of China's macroeconomic prosperity index, we find that the growth rate of the former is significantly higher than the latter. In the long term, the quarterly average growth rate of the coincident index of China's optical fiber and cable industry since 2012 is 0.78 while that of China's macroeconomics is only -0.31. In the short term, the leading, coincident and lagging synthesis index of China's optical fiber and cable industry all maintained positive growth in Q3 2016, while in the same period, such index of China's macroeconomics showed a negative growth trend. Moreover, the Top 5 Chinese optical fiber and cable manufacturers ranked 2nd, 3rd, 6th, 7th and 9th in the list of Top 10 competitiveness enterprises in the optical fiber and cable field of Global market, which reflects Chinese enterprises' strong competitiveness. Considering the long-term trend, the coincident index continues to grow, indicating that China's optical fiber and communications market has developed rapidly, continuously, and healthily. Network infrastructure, industry scale and business innovation together

comprehensively reflect the sustained and rapid development of China's optical fiber and cable industry. Over the past 5 years, the scale of the industry keeps growing rapidly. Figure 2 shows the total sales revenues of China's Top 10 competitiveness enterprises in the optical fiber and cable industry during 2006-2015. From the short-term trend, in the last four quarters, the volatility of coincident index is obvious, which indicates that China's optical fiber and cable industry fluctuates up and down recently. The coincident synthesis index from Q4 2015 to Q3 2016 is 104.4, 104.6, 104.8 and 105.8 respectively in upward fluctuation, indicating that China's optical fiber and cable industry maintains an overall good development trend. In the past year, the month-on-month fluctuation of the coincident synthesis index is obvious, up 1.96, 0.19, 0.28 and 0.92 points in the 4 quarters respectively, indicating that the industry's growth rate meets ups and downs, especially in Q1 and Q2 in 2016 when the growth rate slows. The slowdown of industry is mainly due to the sharp volatility of the capital market and the fierce competition in the market. Despite of the continuing growth in demand, the competition in the domestic market is more intense. Some leading enterprises have obvious competitive edge while the small and medium-sized enterprises face much pressure, thus accelerating the integration of the optical fiber and cable industry. The leading enterprises are expected to further consolidate the oligarchy pattern in the future. In addition, various factors such as macroeconomic downward pressure, leverage-removing in the capital market as well as enterprises' measures of speeding up transformation and investment and reducing short-term profits all have certain influence on the prosperity index.

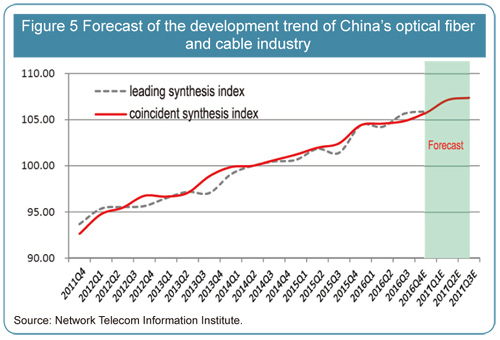

The leading synthesis index shows a sustained upward trend. The index in Q2 2016 and Q3 2016 is 105.7 and 105.9, up 1.42 and 0.25 points month-on-month respectively, which reflects the industry's strong potential for further development. The leading index shows that China's optical fiber and cable industry will keep the trend of fast growing the next year. By observing and analyzing the peak and trough values of the leading and coincident index from Q4 2011 to Q3 2016, we find an obvious rule that values of the leading index are always 2 months ahead of that of the coincident index. According to Figure 5, the leading synthesis index continues to maintain positive growth from Q2 2016 to Q3 2016, while the month-on-month growth rate drops slightly. Thus we predict that China's optical fiber and cable industry will maintain in high prosperity from Q4 2016 to Q3 2017.

Through the above analysis of prosperity index and forecast in the field of optical fiber and cable industry of China, we have reason to believe that the optical fiber and cable industry of China will remain in rapid development for a long period in the future and will play an increasingly important role on the global stage. At last, on behalf of all members of the review group of "Top 10 Competitiveness Enterprises in the Optical Communications Field of China & Global market during 2015-2016", may I extend my sincere gratitude again to all colleagues' help and support for the ranking events in the past 10 years! Thank you!

|

Ranking of "The Top 10 Competitiveness Enterprises in the Optical Communications Industry of China & Global market during 2015-2016" |

|||||||

|