Preface • Work summaryAt the beginning of 2020, a sudden outbreak of COVID-19 spreads around the world, which seriously influenced the global socioeconomic development and caused the deceleration of the construction of 5G both in China and the world. The fact that 4G network construction and Fiber to The Home project has reached to its peak but the large-scale construction of 5G has not yet been established, as well as the adjustment of supply and demand in the field of fiber and cable and the declination of operators’ traditional business led to weak global demand, overcapacity, inventory levels rise and fiber price fall.

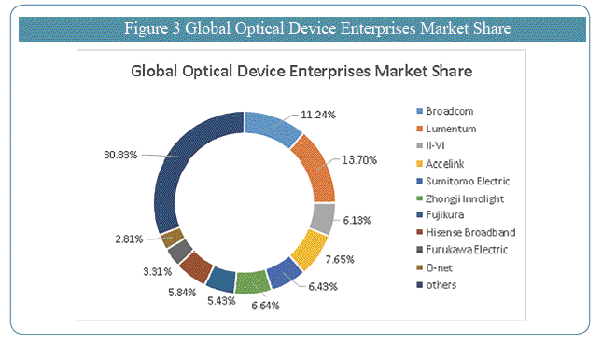

In the global optical transmission and network access equipment list, Huawei continues to maintain a leading position with a comprehensive competitiveness score of 73 points higher than the second place, COSCO communications. The top 10 companies in this list are from 5 countries: Finland (Nokia), Japan (NEC, Sumitomo Electric), the United States (Ciena, Ericsson, Infinera), China (Huawei, ZTE, FiberHome), and Germany (ADVA). Among them, Huawei keeps a firm grip on the lead, with a global market share of 20.49% in optical transmission and network access equipment. Ciena ranked second with 14.33%, Nokia ranked third with 10.97%, FiberHome ranked fourth with 12.45%, Ericsson ranked fifth with 10.24%, and ZTE ranked sixth. Infinera, ADVA and Sumitomo Electric occupied 5.01%, 7.26%, 3.49% and 1.28% market share respectively.

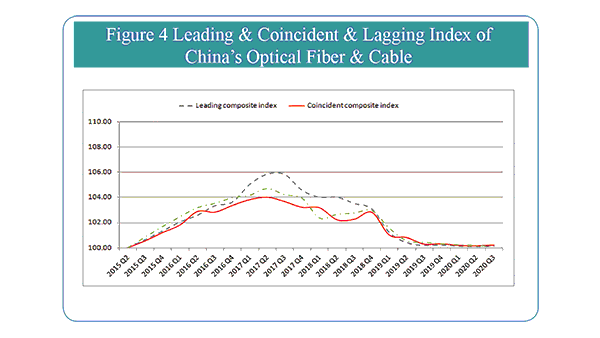

In 2019, the global optical devices and optical modules market underwent great changes, and the integration of the leading industries reached the peak. II-VI acquired Finisa, Lumentum acquired Oclaro, And Cambridge Acquired The Japanese module business of Oclaro, etc. In addition, the market share of midstream manufacturers has increased, followed by the intensifying competition. In the next five years, the 100Gbps and higher rate optical module market will account for more than half of the global optical device market. The key devices in 100Gbps optical module -- 25Gbps/28Gbps electro-absorption-modulated laser (EML) and distributed feedback laser (DFB) chip are in short supply, and enterprises with core raw materials and chip technology will occupy a favorable position in a competition Among the world's top 10 optical device manufacturers, three are from the United States, three are from Japan, and the remaining four are all from China (Accelink, Zhongji Innolight, Hisense Broadband Multimedia and O-net). This proves that Chinese enterprises have made great progress in the field of optical devices and narrowed the gap between the United States and Japan, which have strong competitive advantages. Accelink is still ranked fourth this year, the same as last year, and Zhongji Innolight and O-net ranked sixth and 10th respectively. In terms of market share, Broadcom, the first II-VI, the second and third ranked companies, have 13.7% and 6.13% respectively. In fourth place, Accelink has a market share of 7.65%, compared with 6.43% for Sumitomo Electric, 5.43% for Fujikura and 3.31% for Furukawa Electric.

Since 2019, the downside risks of the world economy have been exacerbating in the context of the treacherous international and domestic situation. Furthermore, the significant increase of the uncertain factors, and the widespread of the global epidemic resulted in the fact that the optical fiber cable industry development in China had begun a slow decline in the second quarter of 2020, the listed cable enterprise revenue growth is also at a slowing pace, in addition, the volatility of the total market capitalization, the continuous declination of the investment and the differentiation of the industry pattern. All these show that optical fiber cable industry in China has come into a stage of mature and stable adjustment.

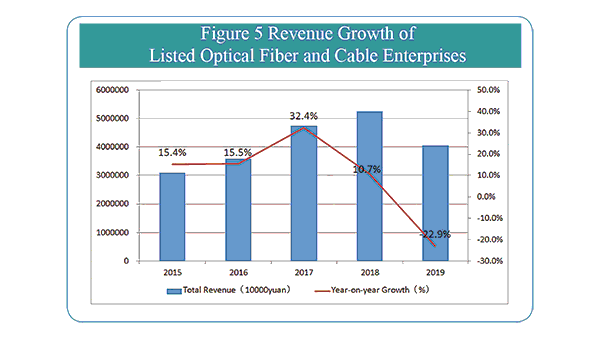

Both the consensus index and the leading index fell. Due to the impact of COVID-19, the overall growth of China's optical fiber and cable industry slowed down in the third quarter of 2020. The consistent index was 100.21, down 0.07 points from the previous year (Q2 2015 =100, the same below), reflecting the development of the industry in the current period. The leading index, reflecting the future trend, was 100.12, down 0.06 points year on year. It indicates that the development of China's optical fiber and cable industry is still in the business range with the index greater than 100. Otherwise, the declination of both consistent index and the leading index shows that the industry will enter a new stage of transformation and adjustment.

(II). The growth rate of revenue scale decelerated Revenue growth slowed to -22.9%. In 2019, the revenue of listed optical fiber and cable enterprises totaled 38.512 billion yuan, with a year-on-year decline of -22.9%. The growth rate of revenue increased significantly, with 15.4%, 15.5%, 32.4% and 10.7% from 2015 to 2018 respectively. In 2019, the industry growth rate decreased by 33.6% points compared with 2018, showing an accelerating downward trend.

As the year As the year 2020 passes, the otical fiber and cable industry is facing unprecedented challenges due to internal and external factors such as accelerated network infrastructure construction, severe epidemic situation, prominent development problems in the industry, the affected macro economy, and the complicated international situation. At the same time, new development opportunities are opening up in many areas. Looking forward to 2021, we believe that China's optical fiber and cable industry as a whole will maintain steady development.

Finally, all the members of the review team of "Network Telecom" and "Annual Global | China Top 10 Competitiveness Enterprises in Optical Fiber & Cable Field" would like to sincerely express our gratitude for the participation and cooperation from the industry colleagues over the past 14 years!

|

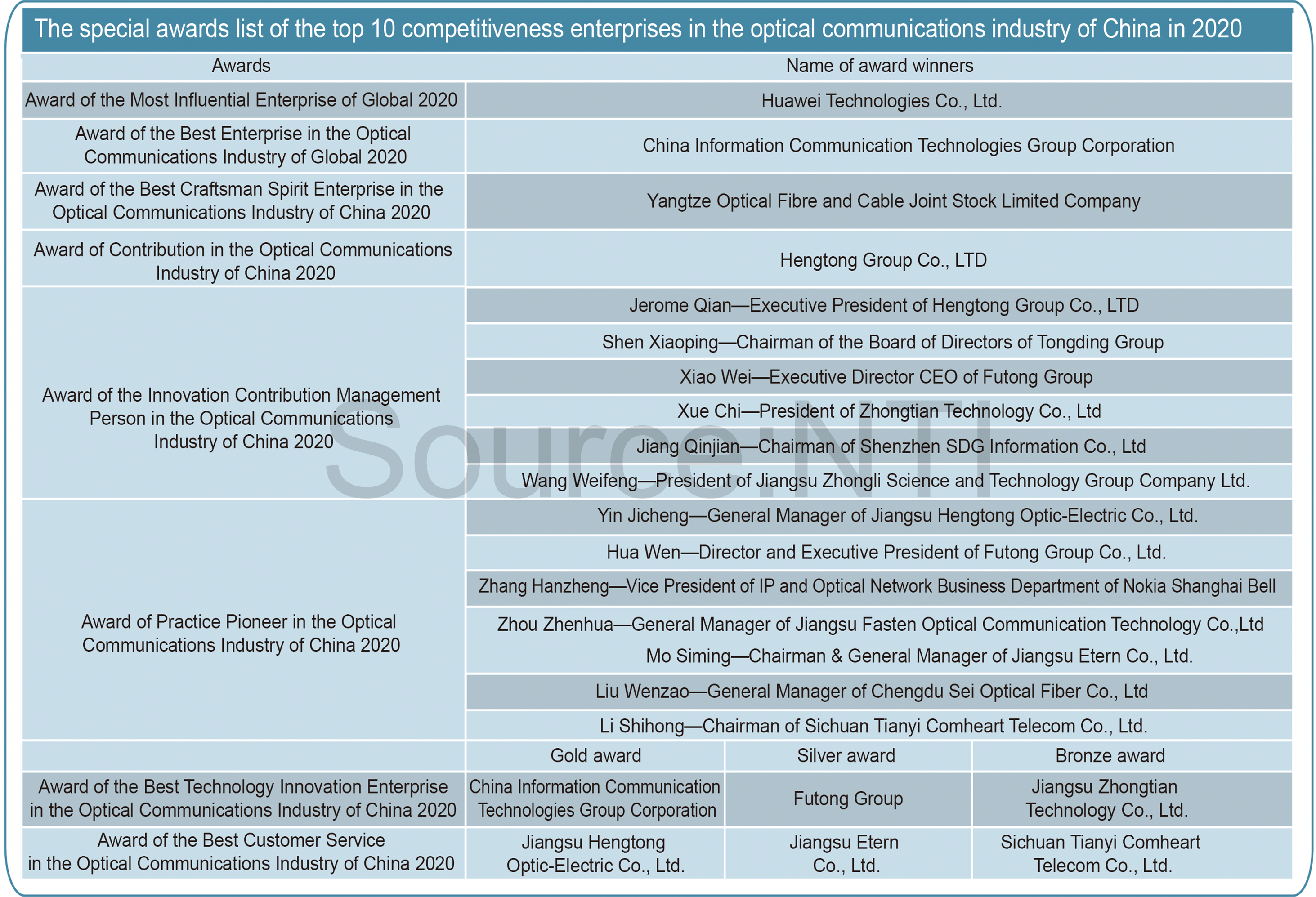

Ranking of "The Top 10 Competitiveness Enterprises in the Optical Communications Industry of Global & China market in 2020" |

|||||||

|